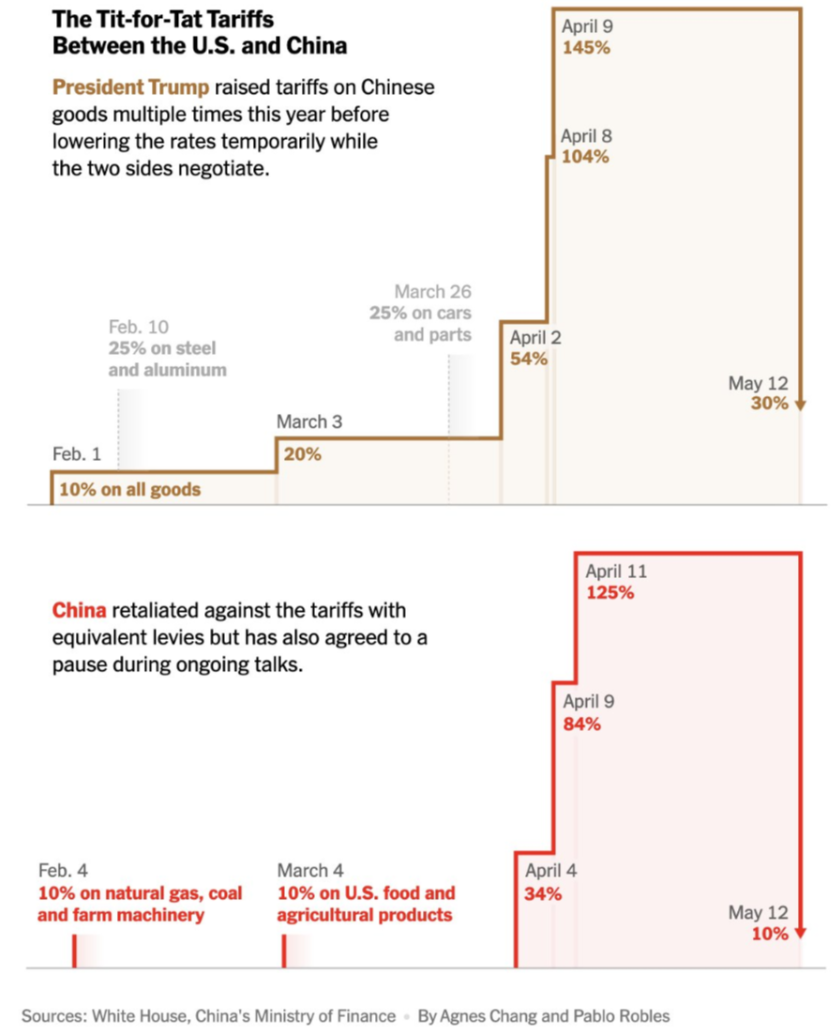

First, let’s touch base on Monday’s news: the US and China will temporarily lower tariffs on each other’s products in a move to cool trade tensions and give the world’s two largest economies three more months to resolve their differences. The combined 145% US levies on most Chinese imports will be reduced to 30%, including the rate tied to fentanyl, by May 14, while the 125% Chinese duties on US goods will drop to 10%. This is sending stocks into risk-on mode.

This should bring down tariff revenue by $300B, bringing the “static” tariffs down to only $260B. This should be viewed as a de-escalation and a new floor. We’ve seen where the pain points are, as the US is worried about empty shelves and small business layoffs. China is worried about a significant collapse in its economy.

Right now, we are seeing the U.S. outperform international securities over this news; we’ll see if this is enough to buck the trend of International > Domestic.

Let’s begin.

The Great International Debate

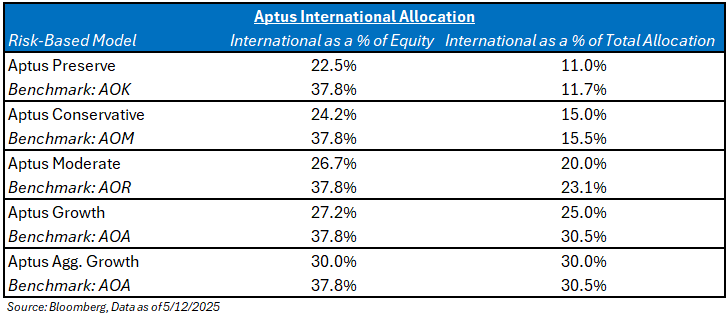

Almost every single day it feels like we’ve been asked about our positioning in the international space. Like most allocators, there has been a structural underweight to this asset class for years. But, many investors now are calling into question the “U.S. Exceptionalism” and have started increasing their International allocation. Personally, I’m not buying into all of this hoopla, as much of the move has been valuation and currency-based. I would say that our off-the-shelf models, coined the Impact Series, do have a structural underweight relative to the index. Yet, I think we need to think about this in two ways, 1) on a relative- and 2) on an absolute basis.

On a relative basis, we are underweight the benchmark to International as a percentage of equity. But our philosophy of more stocks, less bonds, while remaining risk-neutral, skews this figure. For example, our “Moderate” allocation owns 75% stocks, but maintains a 60%/40%-like standard deviation; you can see all the information on page 31 in our Asset Allocation slide deck (send us an email if you’re interested in viewing). On an absolute basis, we aren’t wildly underweight to the overall exposure of the benchmark.

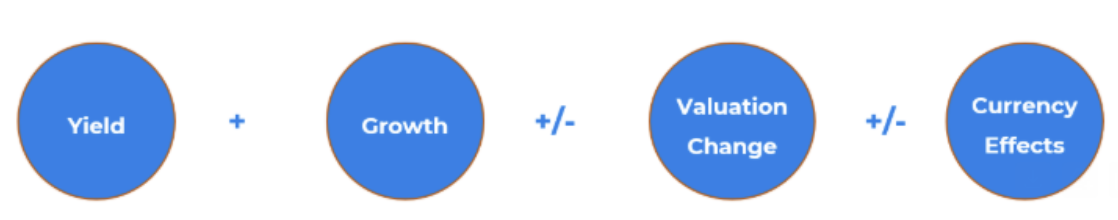

Everyone knows Aptus’ Yield + Growth Framework, but when it comes to International securities, there is a fourth element: currency translation. More simply, a strengthening dollar hurts International returns, while a weakening dollar helps.

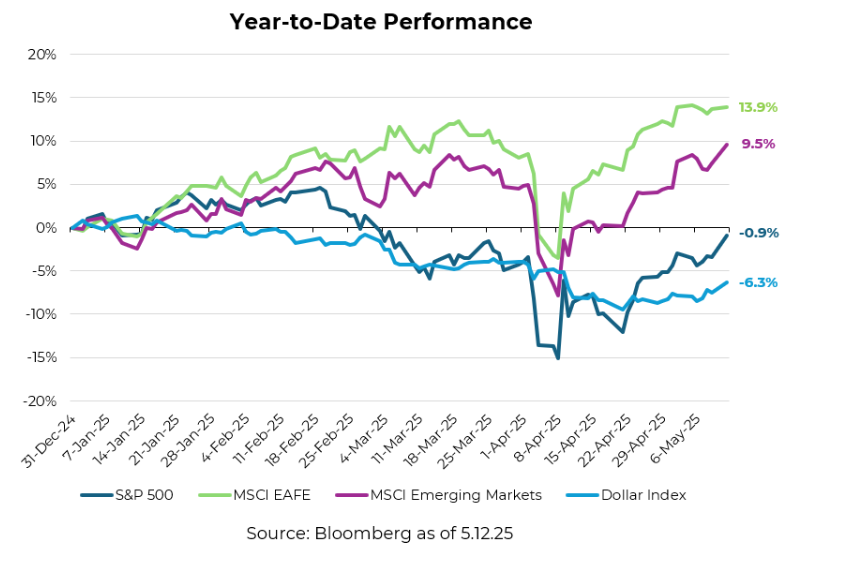

Year-to-date (YTD), the majority of the relative outperformance for International has come from the latter two: Valuation Change and Currency Effects. YTD, the MSCI EAFE has outperformed the S&P 500 by 14.82%. Currency has driven 43% of the relative outperformance, while valuation change (International’s multiple increasing + US decreasing) has contributed the remaining 57%. Now, let’s walk through each factor:

Currency

I’m not sure that one can confidently say that currency effects are mean-reverting, but they tend to oscillate over longer periods of time. Aptus’ house view is that all currencies are depreciating, just some are depreciating faster than others. This makes directional currency calls very difficult, almost impossible. And given the USD’s move has been pretty substantial already this year, I’m not sure that investors can continue to count on this variable as a tailwind for International securities. Playing currency should not be an investment thesis on the asset class.

Valuation Expansion

The S&P 500’s valuation has declined, while the MSCI EAFE’s valuation multiple has expanded. This is the market saying that it is attempting to price in more International growth – for example, Germany has a debt to GDP ratio of 71%, and the market believes that it can use fiscal policy to engineer more growth, specifically in the defense sector. This “Hopes and Dreams” valuation is counting on more International growth in the future, and if it doesn’t happen, the valuation could be at risk.

Since the big question is where the growth will come from, let’s dig in deeper to try to answer this question. In a nutshell, capital has come out of the U.S. and chased foreign returns for two reasons:

- There is too much market concentration in the U.S., and

- International should witness positive earnings revisions, driving higher-than-expected sales and earnings growth.

I’ve been speaking at a bunch of conferences over the last month, and a common investment theme is that the U.S. is too concentrated (from a weighting perspective) and that it tends to presage better returns for areas of the market that have more breadth, i.e., International, Small Caps and the S&P 493. Said another way, there is too much concentration in the market, and the concentrated areas are overvalued. But, if you read our 2025 Market Outlook, you’d know that we aren’t perma-bears hating on the Index construction; rather, we believe that it’s a reason to be more optimistic than pessimistic. And to take it a step further, the U.S. isn’t really that concentrated relative to the rest of the world.

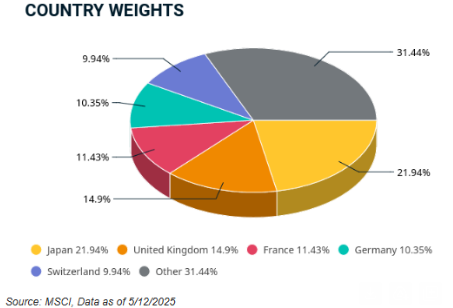

MSCI Country Weight

As an investor, you have to know and understand what you own to have conviction in an idea instead of just chasing performance. I understand that at the 10,000-foot view, the MSCI doesn’t have concentration issues because it’s a diversified index of countries, but I would say that each of these countries has its own concentration issues. Yes, International securities are substantially undervalued relative to their past, at the index level, but I think there has simply been a re-rating due to growth concerns.

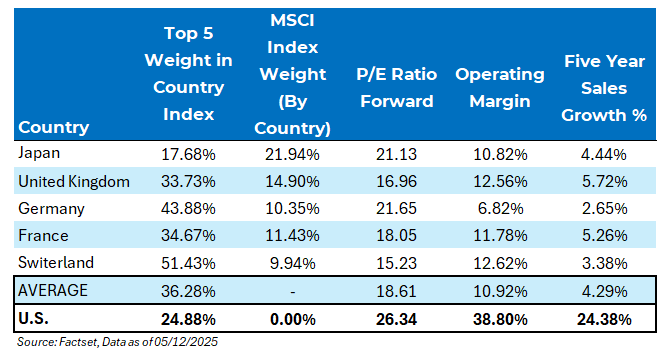

If we take the most heavily-weighted countries in the MSCI EAFE, which account for over two-thirds of the index weighting, and look at what their concentration is and the growth is, it’s not that exciting.

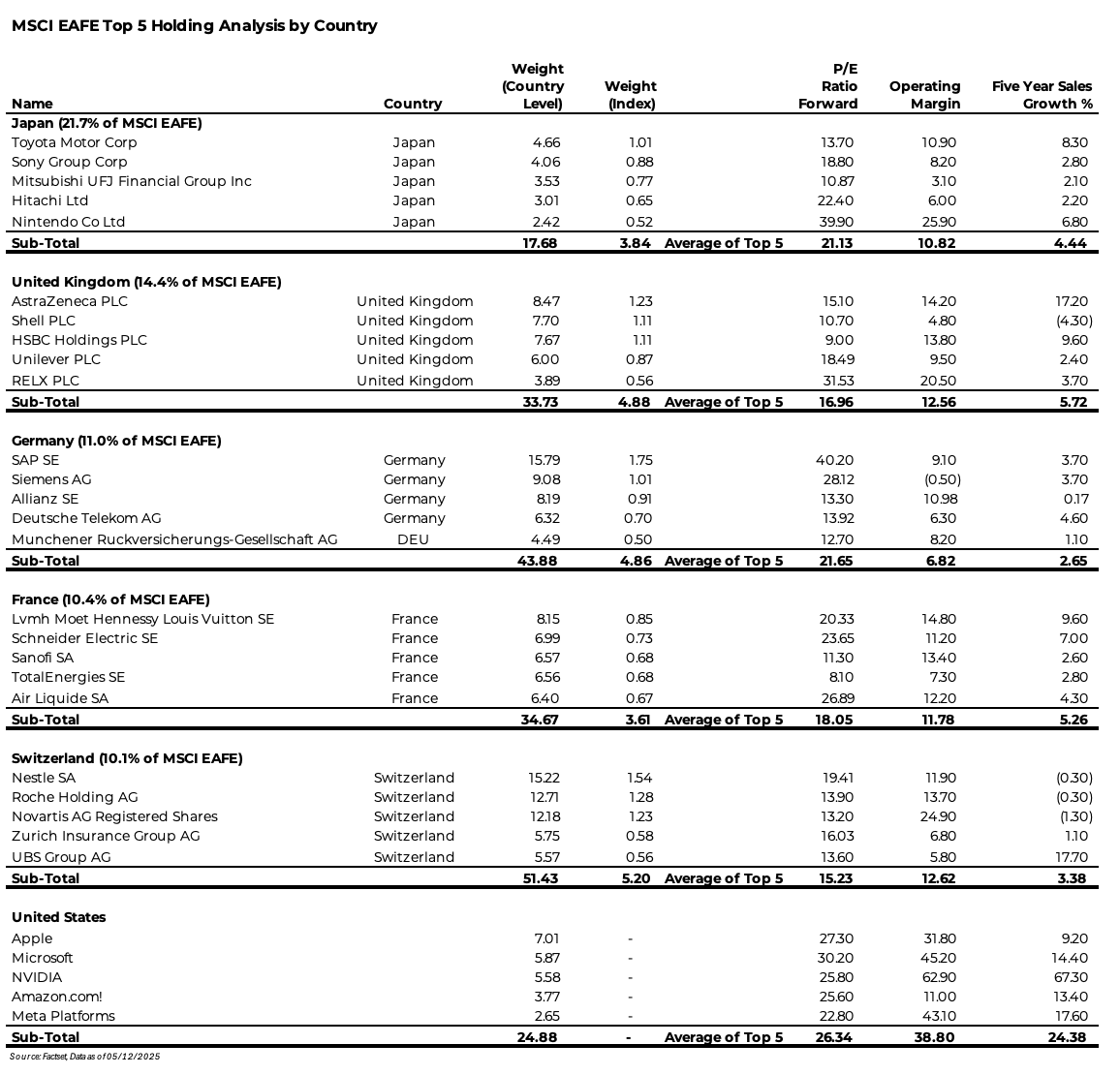

Every country except Japan has worse concentration issues than the U.S., but all have lower growth rates and operating margins. Then, if you take it a step further and look at the holdings that comprise each country, you’ll notice that, like the U.S., there is concentration in securities, but these concentrated holdings are also highly valued. For example, SAP in the DAX index is almost a 15% weighting that sports a 40x forward P/E and a growth rate of 4% – and this isn’t the only example within the aforementioned country indices.

This shows that many of these countries are top-heavy in weighting and are also highly valued. Yet, the MSCI Index is trading at historically low valuations, on an absolute basis, but also on a relative basis to the U.S. We’ve known that International tends to trade at an 8% discount to the S&P 500, but now trades closer to a 40% discount. If International is also very top heavy on weighting and valuation, that just means that the rest of the companies that fill out the index (i.e., not in the Top 5) are very low quality— which scares me —because to get that low of a valuation, at the benchmark level, that means that the remaining stocks are so very cheap and they’re probably cheap for a reason.

Pound-for-pound, you get more growth and higher profitability in the U.S. per unit of valuation.

Overall

This leads to the biggest question that we should be asking ourselves: “How underweight do we want to be?”, not “Do we want to go overweight International”?

We all know the diversification benefits of International, and we are seeing it this year, so it merits a spot in an overall allocation. But just how large of a spot? Because I don’t think that global investors will suddenly stop seeking out superior US profitability. And the above charts prove that the U.S. has better growth and profitability for a valuation not that widely higher than what headline data tends to skew. As I’ve said multiple times, in my opinion, the profitability aspect of the U.S. is one of the biggest reasons to be optimistic about the U.S. over International.

One of the hardest decisions that portfolio managers and allocators have to make is when to change their opinion on a certain investment subject. This decision gets even more difficult when trying to recognize if there is a seismic shift in a certain theme that’s lasted for over a decade, and that’s what we are now witnessing.

There’s been a ton of head fakes on this trade, and only time will tell if this is another one. But, at the end of the day, the most important thing that we should be doing is making sure that we have a plan in place to monitor this position and what tangible data would make us change our current allocation…Objective > Subjective. And for us to become more constructive on foreign stocks, we need to see tangible growth out of some of the larger countries. Until that happens, I think the easy money of this trade has happened, given that all the relative outperformance has come from valuation expansion and currency translation.

Now, I could be wrong here, but I’m willing to miss out on the first few innings of a trade that has historically produced a lot of head fakes until I am able to make sure that it is an actual seismic shift away from the U.S.

Stay nimble and not too Bullish, not too Bearish.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-12.