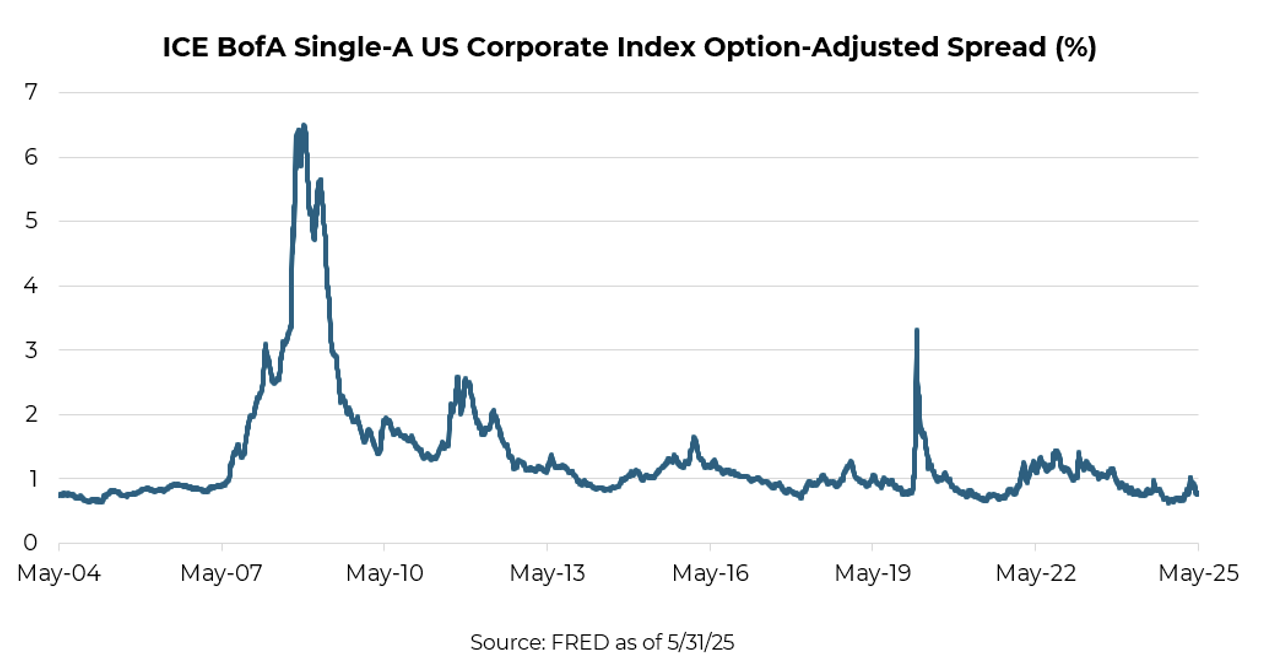

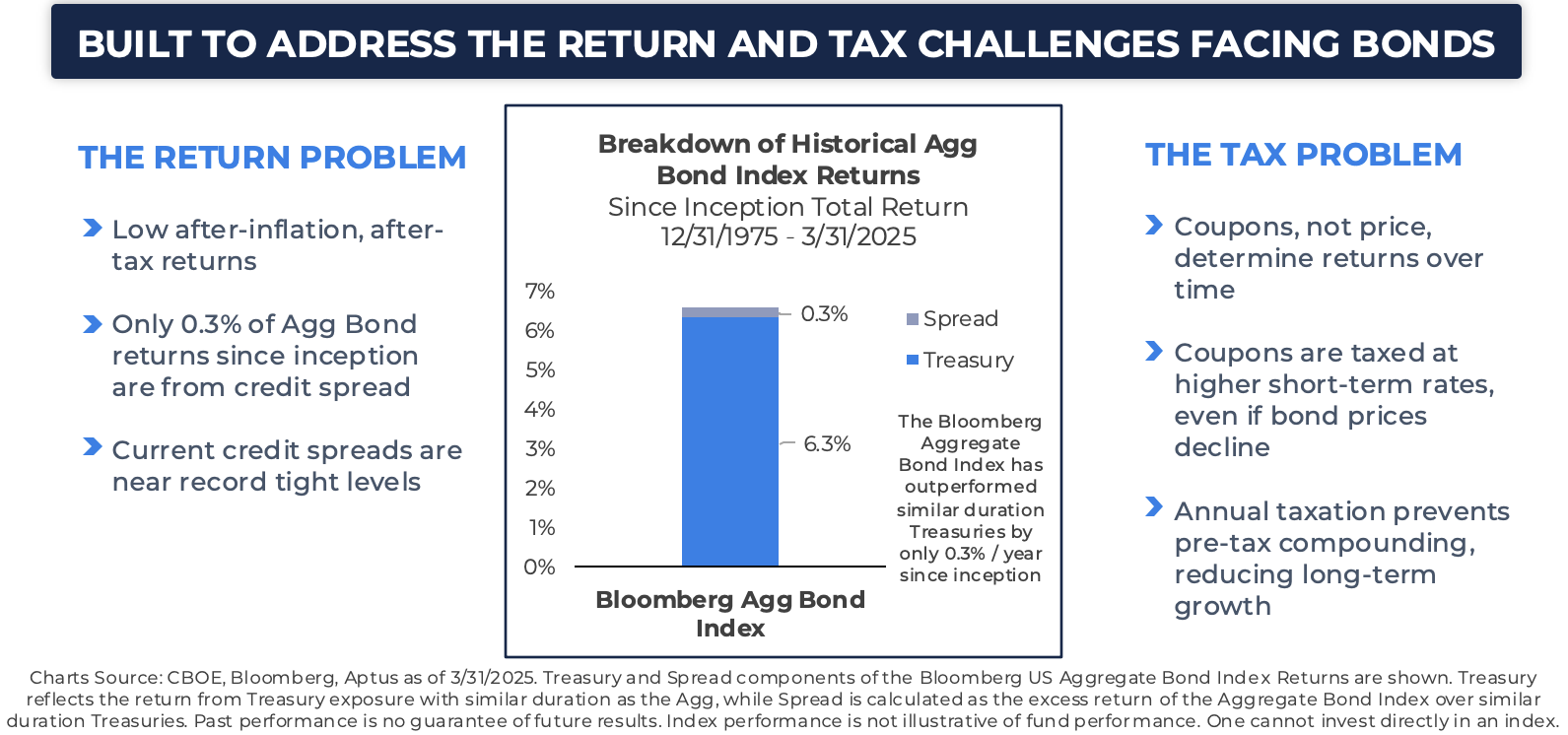

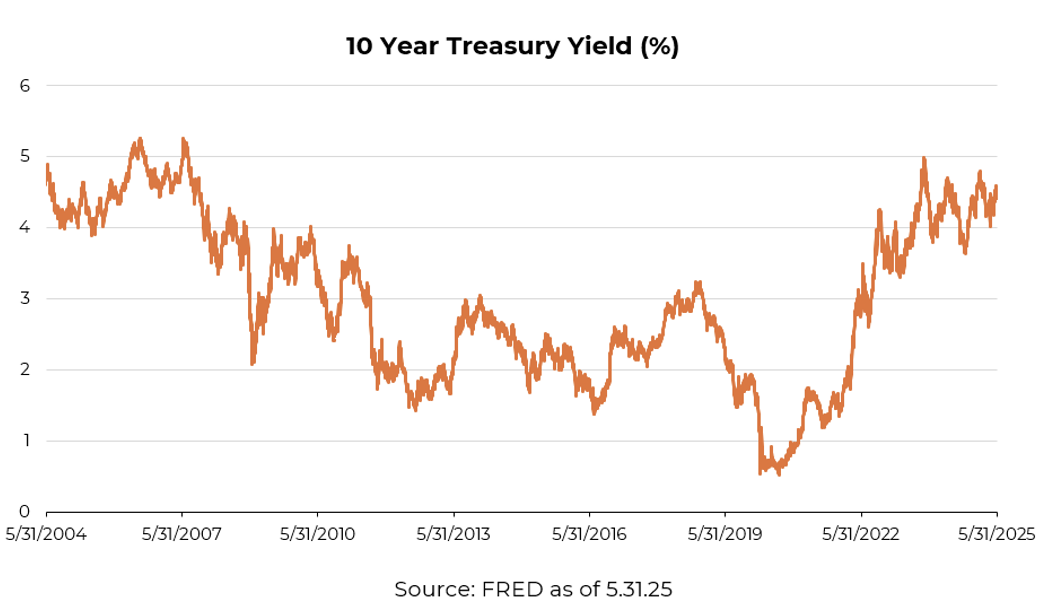

In this rebalance, we’re tackling a challenge that has become especially acute in recent months: insufficient return potential in bonds. While credit spreads are meant to compensate investors above the risk-free rate of Treasuries, the current compensation is even less than the generally low levels of much of the past decade.

The other inherent challenge for (non-municipal) bonds is the poor tax treatment. Income is taxed at the highest levels possible, further eating into investor returns. Solving both the return challenge and the tax challenge in a single strategy has been elusive, but we feel confident in our newfound ability to accomplish exactly this.

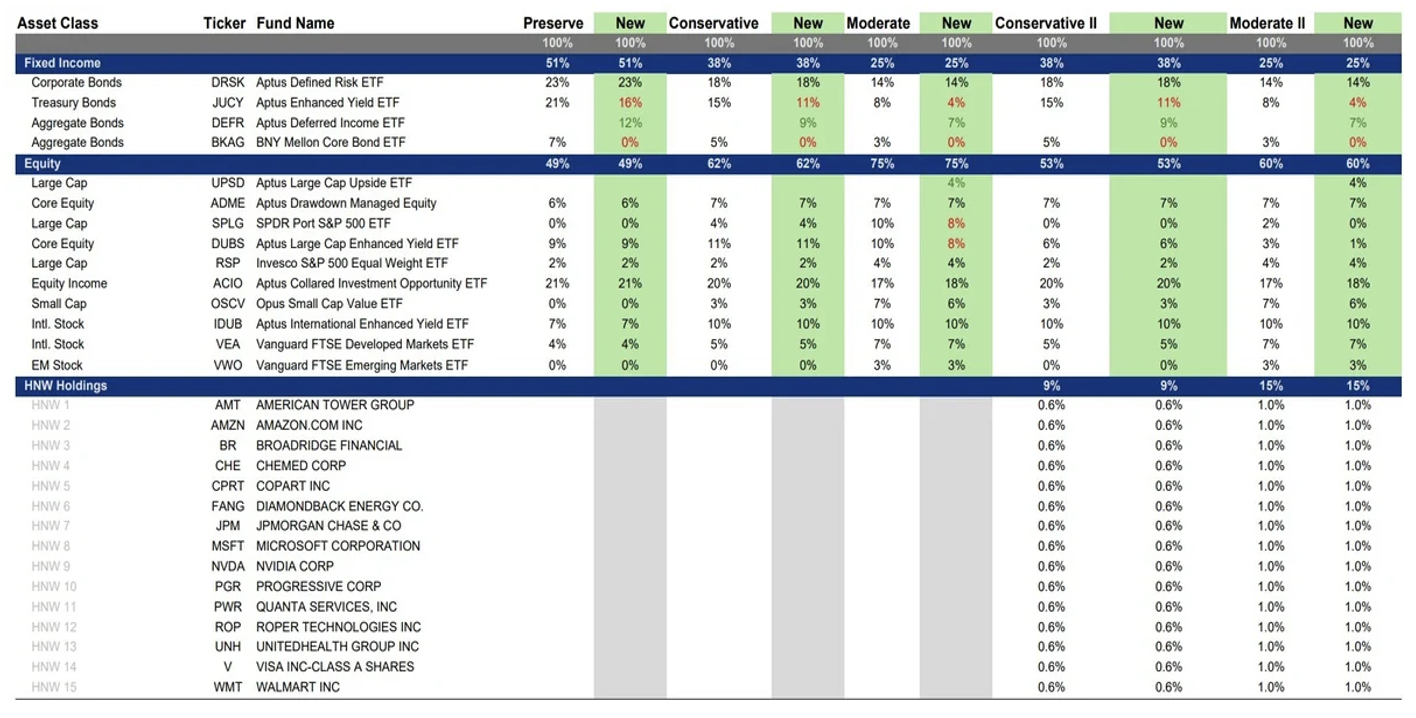

This rebalance is focused on our models at the moderate risk level and below, as an opportunity to enhance portfolio returns while maintaining a risk and diversification profile similar to traditional core bonds. With it, we’ll introduce a new exposure within our fixed income allocation: the Aptus Deferred Income ETF (DEFR), replacing some of the exposures we get from traditional core bonds (BKAG) and shorter-duration enhanced yield (JUCY).

Why We Are Making This Change

Since its inception, the Bloomberg U.S. Aggregate Bond Index has produced a modest annualized return of approximately 0.3% above comparable duration Treasuries. This incremental return, derived from credit spread exposure, has come with increased correlation to equities, limited risk adjusted returns, and harsher tax treatment under short term income tax rates in taxable accounts. In reducing exposure to traditional bonds, we aim to enhance growth potential while managing risk, creating a foundation for sustainable wealth. You can see the changes here:

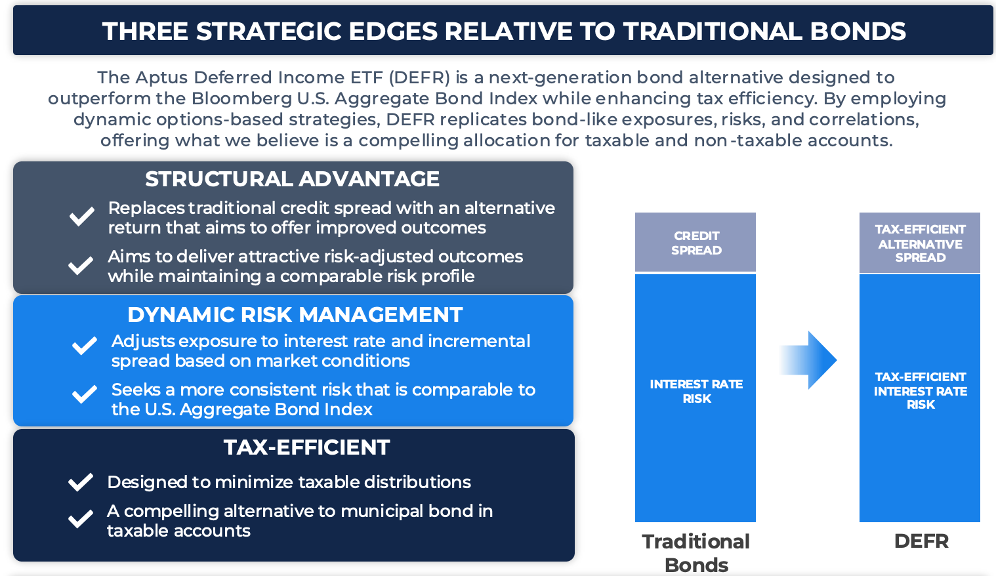

Introducing the Aptus Deferred Income ETF

DEFR is an innovative fixed income solution that manages around the duration and risk characteristics of the Bloomberg U.S. Aggregate Bond Index through tax efficient Treasury exposure. It then adds a secondary return stream by dynamically selling S&P 500 put options at a risk level comparable to the incremental risk of the spread component of the Agg relative to Treasuries. This strategy aims to deliver risk characteristics similar to Agg bonds but with improved performance and more favorable tax treatment.

While DEFR’s tax efficiency is a clear advantage in taxable accounts, the core value proposition extends well beyond taxes. The strategy’s return-enhancing design and flexible duration management make it compelling in all account types, including qualified retirement accounts. In fact, we built DEFR primarily to improve the risk/return tradeoff in fixed income with the tax benefits engineered later, once we had conviction in the underlying approach.

DEFR challenges the traditional bond framework by offering a modern approach to fixed income. It preserves the role of bonds in diversification and downside protection while upgrading the return profile through a dynamic allocation to equity option to collect premiums, which correlate to the spread component of Agg bonds. This strategy is designed to benefit all clients, including those in qualified accounts, by improving capital efficiency and long-term growth potential.

Portfolio Impact

This rebalance is not a wholesale change to our bond exposure but a reallocation of a portion of traditional fixed income into DEFR. The objective is to improve the portfolio’s expected return without sacrificing the defensive role bonds play. From a risk standpoint, DEFR is structured to track the behavior of bonds, not equities, ensuring alignment with our broader mandate: to manage risk intelligently and seek better outcomes for clients over the long term.

As the table above shows, some of the new DEFR allocation will come from Core Bond (BKAG), but we’ll also pull from our Enhanced Yield ETF (JUCY). While we generally find credit unattractive, there’s no denying the overall higher yield environment. An incremental move from JUCY to DEFR adds a bit of duration from our long-standing underweight, with the added flexibility of adjusting as conditions change.

Adding UPSD in Moderate Portfolios

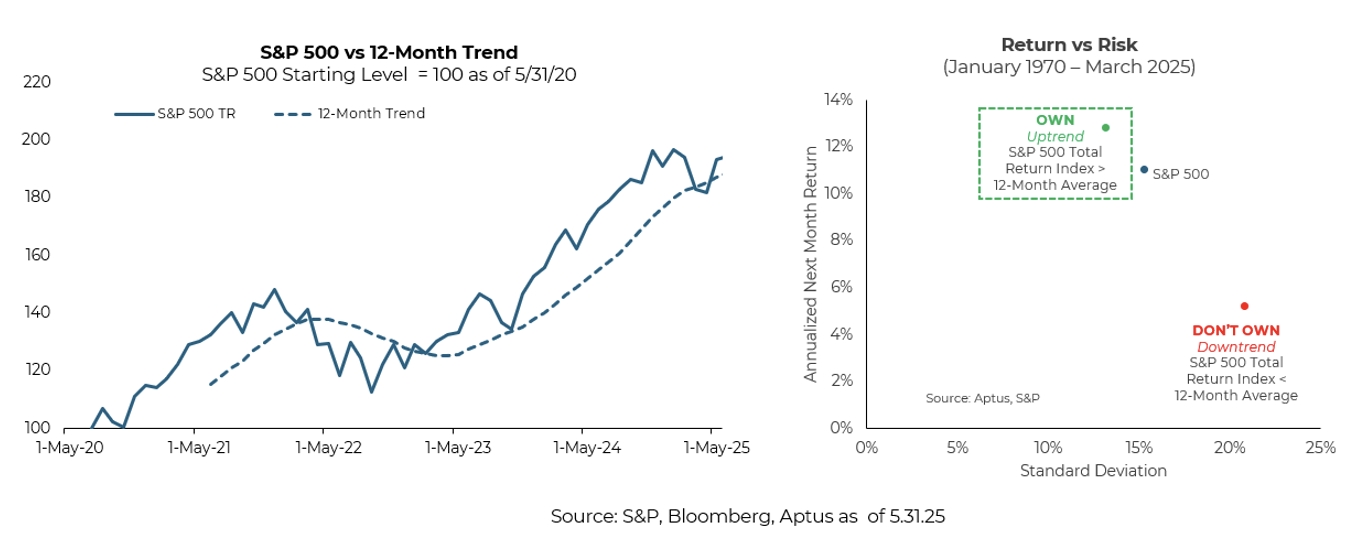

We’re also adding a 4% allocation to the Aptus Large Cap Upside ETF (UPSD) in the Moderate allocations, funded by trimming both the S&P 500 ETF and DUBS (our covered call strategy) 2% each.

UPSD provides dynamic equity exposure that adjusts based on market trends, dialing up beta during strength and pulling back in periods of weakness. This flexibility contrasts with DUBS, which is designed to deliver a consistent option premium to cushion volatility at the cost of capped upside, making UPSD more responsive in trending markets.

Beyond its risk management overlay, UPSD also offers differentiated stock selection. It starts with a low-volatility portfolio and screens for quality, growth, valuation, and momentum, resulting in a core equity allocation that looks and feels different than the S&P 500. The trend overlay then adds back S&P 500 exposure when trends are favorable for that allocation. We view this as a great way to participate a bit more in healthy equity market conditions.

Final Thought

Longevity risk, the risk of outliving one’s assets, is one of the greatest challenges investors face. With inflation and longer lifespans, focusing on real, compounded returns is crucial. Higher returns optimized for tax efficiency are essential to meeting these needs, preserving purchasing power and offsetting rising costs.

Our goal with the Impact Series remains the same: to compound capital over time as efficiently as possible. We think these tweaks give the portfolios an ability to mitigate downside while improving upside return potential.

Thank you for trusting Aptus with your investments. We are happy to discuss the role of DEFR in more detail, including how it complements other fixed income allocations in both qualified and non-qualified portfolios.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Please carefully consider the fund’s objectives, risks, charges, and expenses before investing. The statutory or summary prospectus contains this and other important information about the investment company. For more information, or a copy of the full or summary prospectus, visit www.aptusetfs.com, or call (251) 517-7198. Read carefully before investing.

Investing involves risk. Principal loss is possible.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

This content or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama.

The Funds are distributed by Quasar Distributors LLC, which is not affiliated with Aptus Capital Advisors, LLC. ACA-2506-17.