Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from rare timing setups and market breadth to the economy, earnings, and US/foreign market exposures. Enjoy!

Tariff Tantrum vs. Reality Check

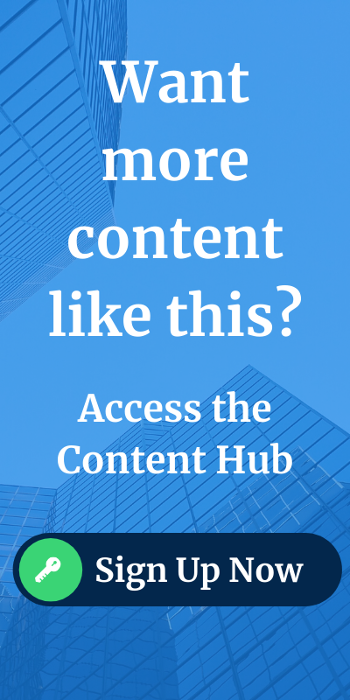

Joseph: Since Trump’s “Liberation Day” tariffs on April 2, soft data (like surveys) has collapsed, while hard data (like jobs and spending) hasn’t budged. It’s a reminder that sentiment often reacts faster than the economy actually does—if it reacts at all.

Source: Citigroup as of 05.28.2025

Source: Citigroup as of 05.28.2025

Divergences Usually Converge

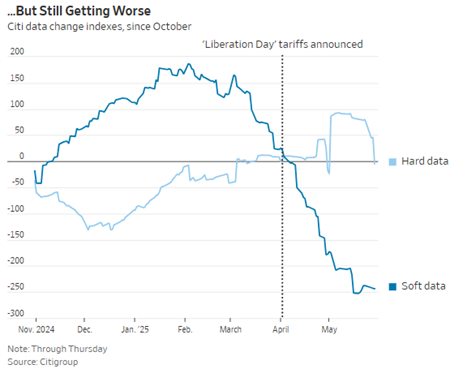

John Luke: While the split between what people feel and what they do is getting louder, they eventually converge. Job growth, income, and GDP are all holding up, with Q2 estimates now pushing higher. Right now, that story still looks solid, even if the vibes don’t match. Which will win?

Source: 3Fourteen Research as of 03.31.2025

Source: 3Fourteen Research as of 03.31.2025

S&P 500 Goes Full Rocket Mode

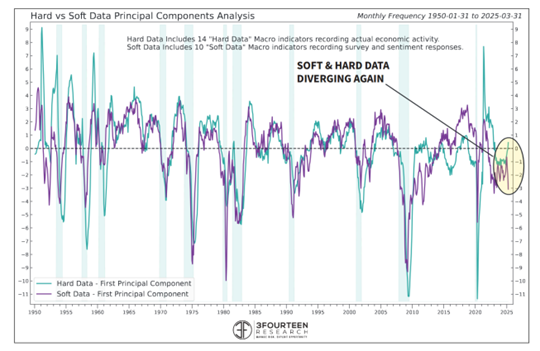

Beckham: A 20 percent move in just 28 days? That’s rare air for the S&P 500. The last three times this happened, the market was higher a year later. Short-term fireworks, long-term signal?

Source: 3Fourteen Research as of 05.28.2025

Source: 3Fourteen Research as of 05.28.2025

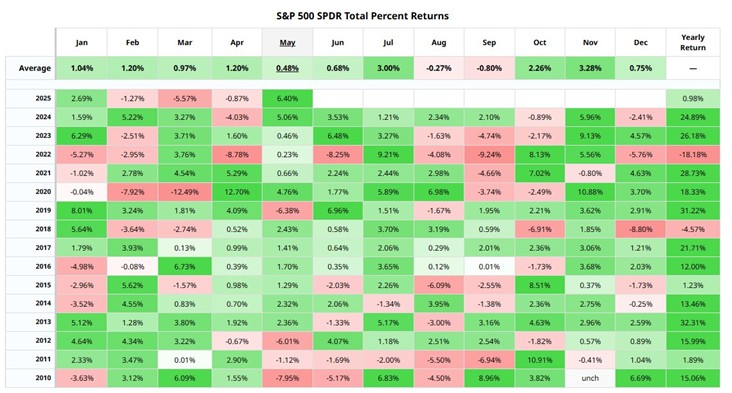

May Meant Business

Dave: The S&P 500 just had its best month since the fall of last year (and second largest month since last May). May continues to show up when bulls need a lift.

Source: Mike Zaccardi as of 05.31.2025

Source: Mike Zaccardi as of 05.31.2025

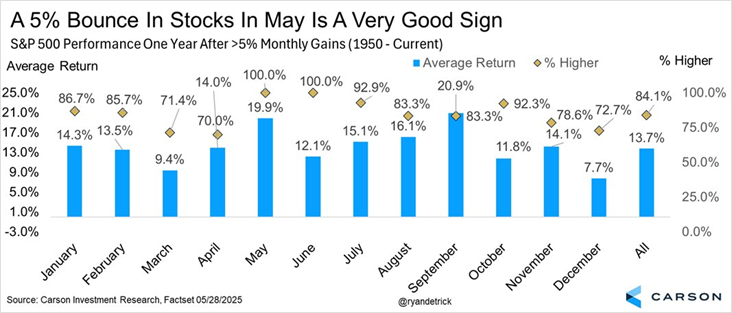

May Strength “May” Mean Strength

Arch: May posted a 5%+ gain for the S&P 500. Why does that matter? Because in every previous case where May gained more than 5%, the market was up over the next 12 months.

Source: Carson as of 05.28.2025

Source: Carson as of 05.28.2025

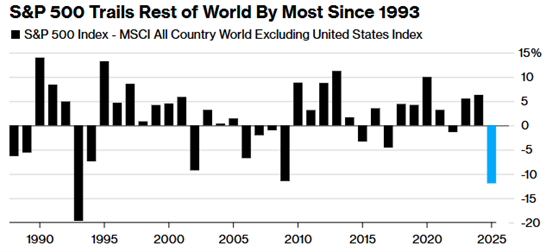

The World Takes a Strong Lead at the (Almost) Halfway Point

Joseph: Despite the bounce in May, the U.S. market is trailing international markets by the widest margin year-to-date since 1993.

Source: Bloomberg as of 05.31.2025

Source: Bloomberg as of 05.31.2025

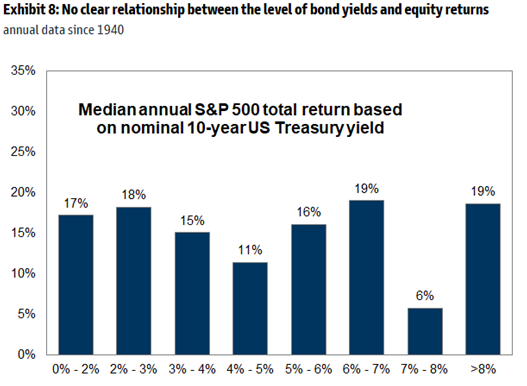

Is it Yields Keeping the US Down?

Brad: There’s no magic interest rate that kills equity returns. Since 1940, S&P 500 returns have shown no consistent pattern based on nominal yields.

Source: Shiller, Goldman as of 12.31.2024

Source: Shiller, Goldman as of 12.31.2024

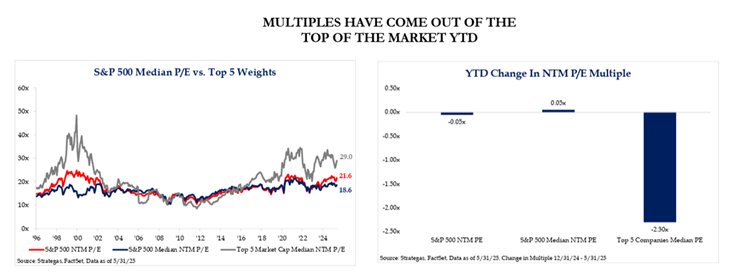

Big Tech’s Valuation Diet

Arch: A portion of the relative lag in the U.S. is due to the MAG-5 seeing their P/E ratios drop as earnings caught up to price. These names are still priced at a premium to the broader market, but the decline has been real.

Source: Strategas as of 05.31.2025

Source: Strategas as of 05.31.2025

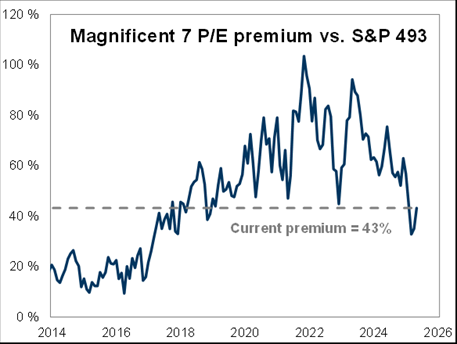

The MAG-7 Premium… It’s All Relative

Brad: Yet the MAG-7 premium in relative terms compared to the rest of the S&P 500 has dropped to 43 percent, the lowest since 2017. Still higher, but justified?

Source: Strategas as of 05.31.2025

Source: Strategas as of 05.31.2025

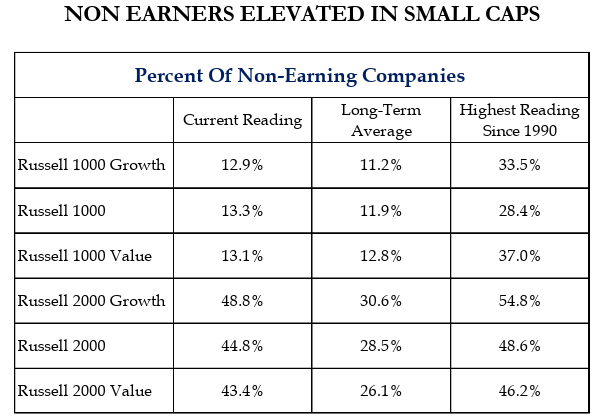

Small Caps, Large Red Flags

Dave: Investors can own small caps at a discount, but in many areas that discount may be justified. While that’s not unusual during speculative episodes, the current level suggests that broad small-cap exposure is still littered with unprofitable firms. An allocation to higher quality small-caps may be the antidote.

Source: Strategas as of 05.31.2025

Source: Strategas as of 05.31.2025

Is the Fed Looking Yet?

John Luke: PCE inflation is sitting at 2.1 percent, right where the Fed wants it. Meanwhile, real yields are at decade highs. If the Fed is really data dependent, the case for a rate cut is getting stronger.

Source: Bloomberg as of 05.31.2025

Source: Bloomberg as of 05.31.2025

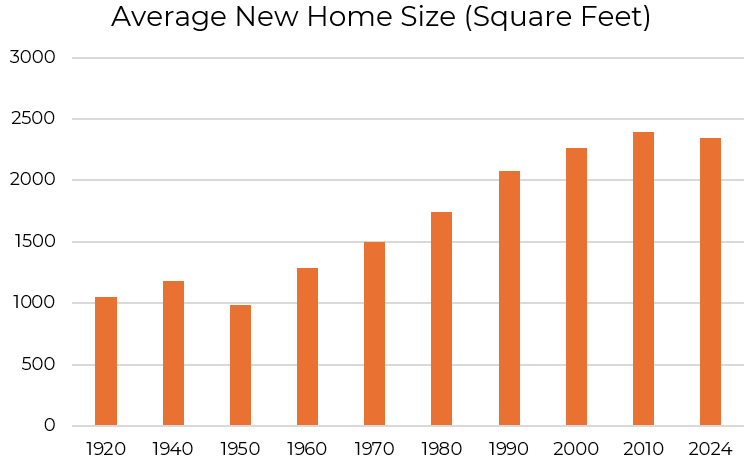

Expensive Doesn’t Always Equal Worse

Brian: Yes, homes used to be cheaper. They were also way smaller (and used to lack plumbing). In 1950, most homes were well under 1,500 square feet, while today, less than 25% are under 1500 square feet. Today, buyers want offices, islands, and three bathrooms. Adjust your nostalgia accordingly.

Source: 24/7 Wall Street, Census, Aptus as of 12.31.2024

Source: 24/7 Wall Street, Census, Aptus as of 12.31.2024

Takeaways

-

- Market reactions and economic reality often part ways

- Seasonality and momentum are alive and well

- Small caps still need a quality filter

- Big tech is still big, but not as bubbly

- Inflation is cooling, but not investor excitement

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2506-30.