Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from earnings and the economy, to international comps and DC taxes and spending. Enjoy!

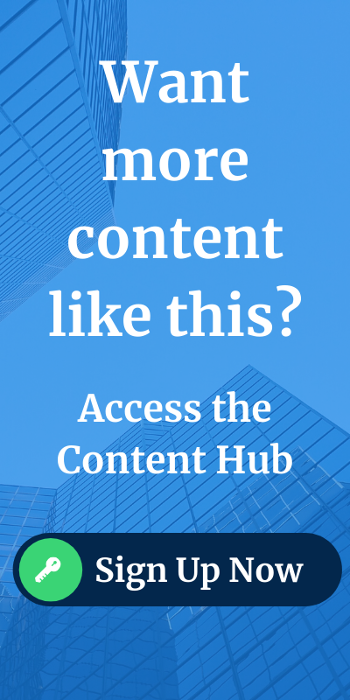

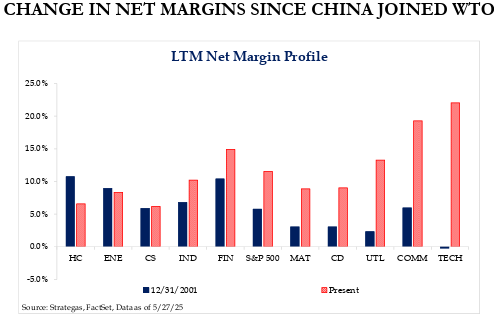

John Luke: The S&P 500 has developed into a much more quality-focused index than in its past

Source: @warrenpies as of 05.28.2025

Source: @warrenpies as of 05.28.2025

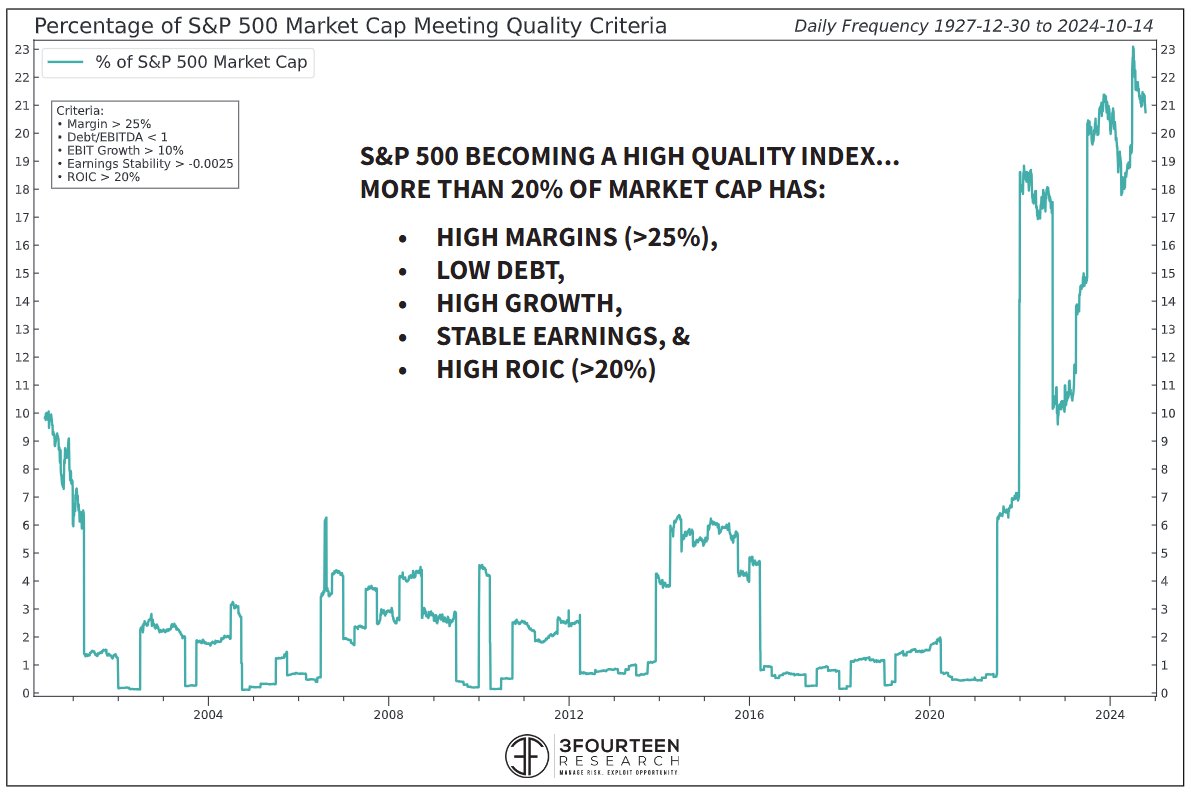

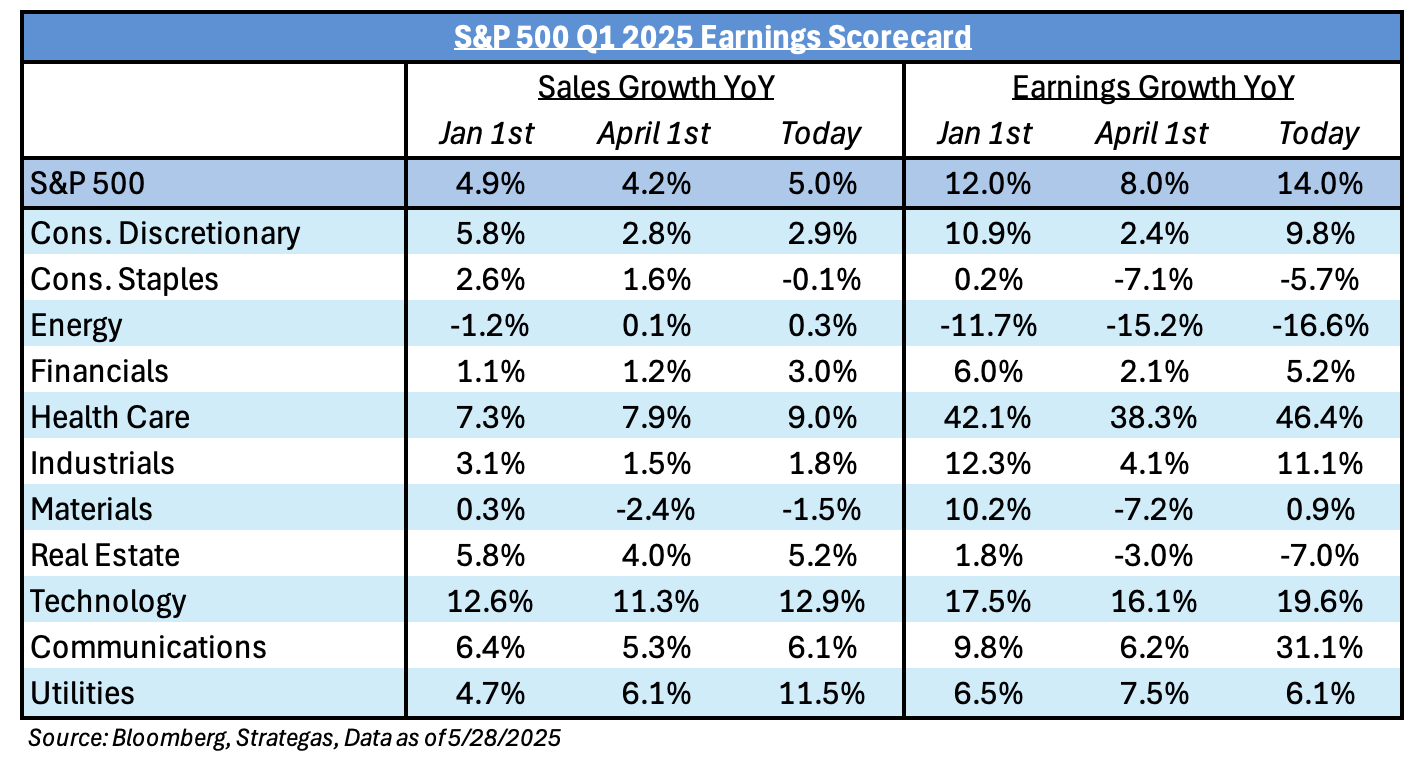

Dave: with Mag 7 tech names continuing to build on their fundamental leadership

Source: Raymond James as of 05.28.2025

Source: Raymond James as of 05.28.2025

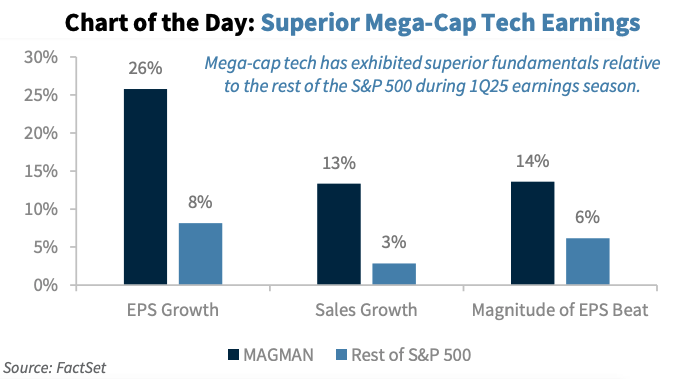

Brett: While the chatter was that Q1 earnings calls would be void of future guidance, companies spoke confidently of their outlooks

Data as of 05.27.2025

Data as of 05.27.2025

Dave: which supported the overall positive tone coming out of Q1 earnings season

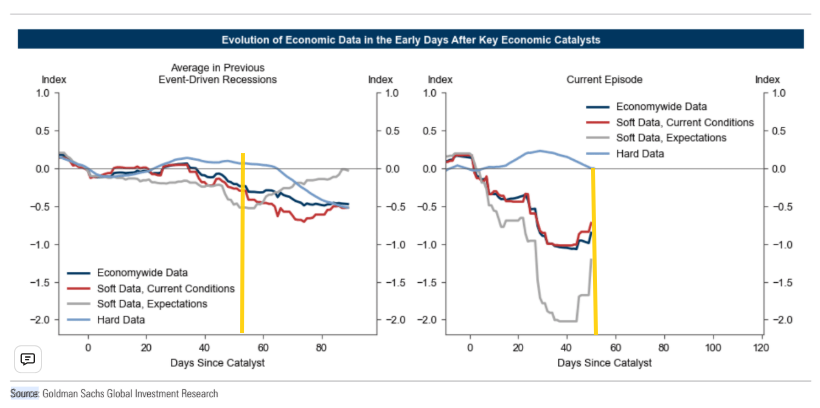

Arch: “Soft data” diverging (and ultimately converging) with hard data is not a new phenomenon

Data as of 05.23.2025

Data as of 05.23.2025

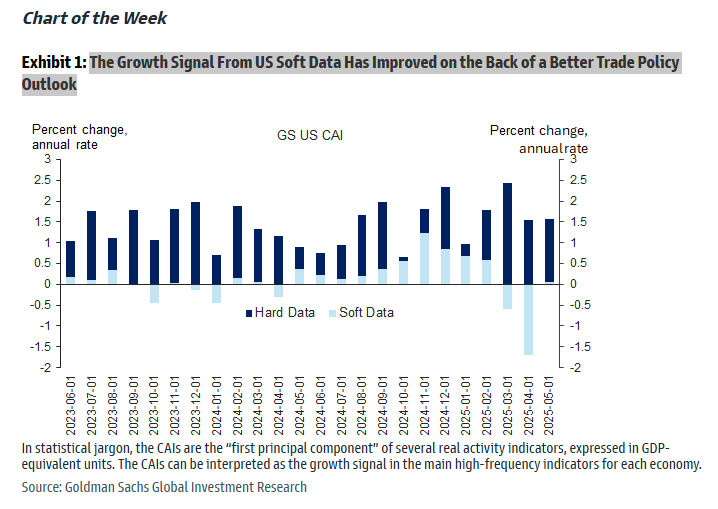

Joseph: and we’re starting to see the (weaker) soft data move in the direction of the hard data as the tariff tantrum subsides

Data as of 05.23.2025

Data as of 05.23.2025

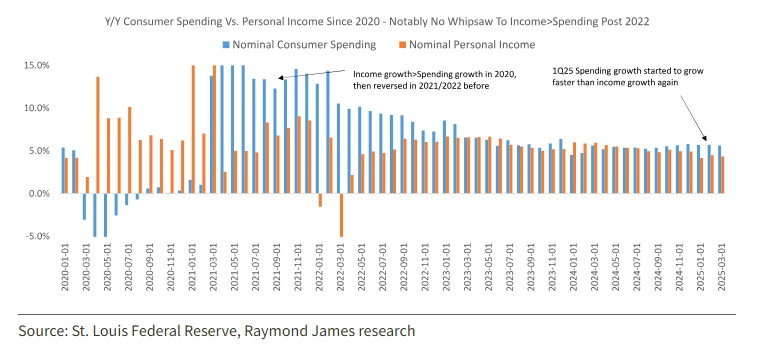

Dave: On the subject of hard data, consumer spending of late has been both consistent and in line with income

Data as of April 2025

Data as of April 2025

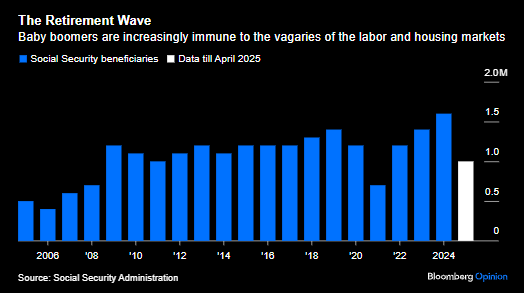

John Luke: with baby boomers the most reliable constituents, spending from both lifetime savings and fresh Social Security checks

Brad: China is no friend to the US as a whole, but the access has been a boon to US companies, especially those in technology and communications

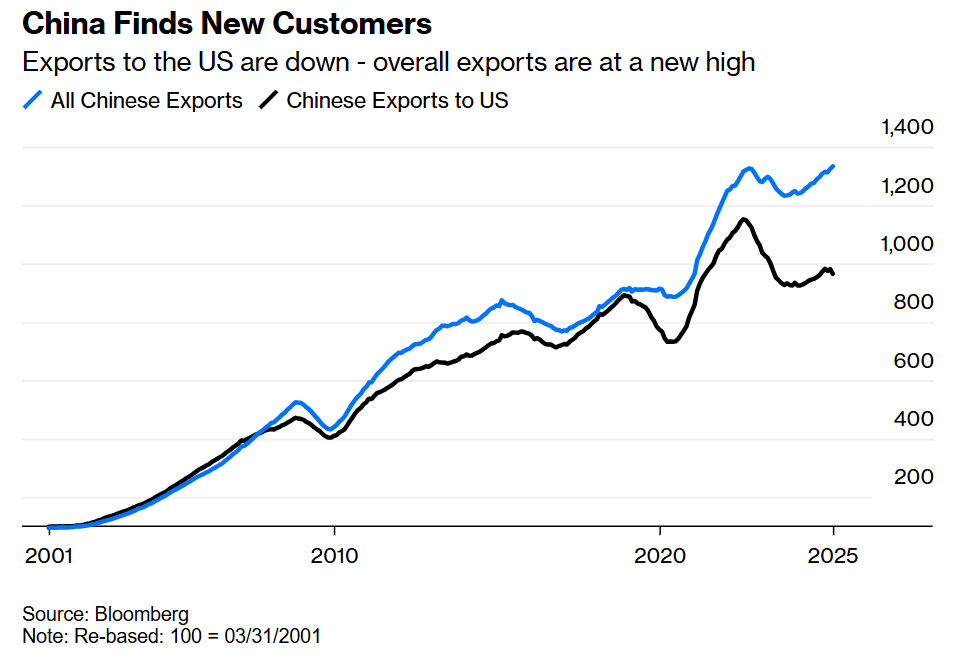

Beckham: and while both US and Chinese corporations have benefited from access to cheaper input costs, China has started to look to other markets to reduce its reliance on the US

Data as of April 2025

Data as of April 2025

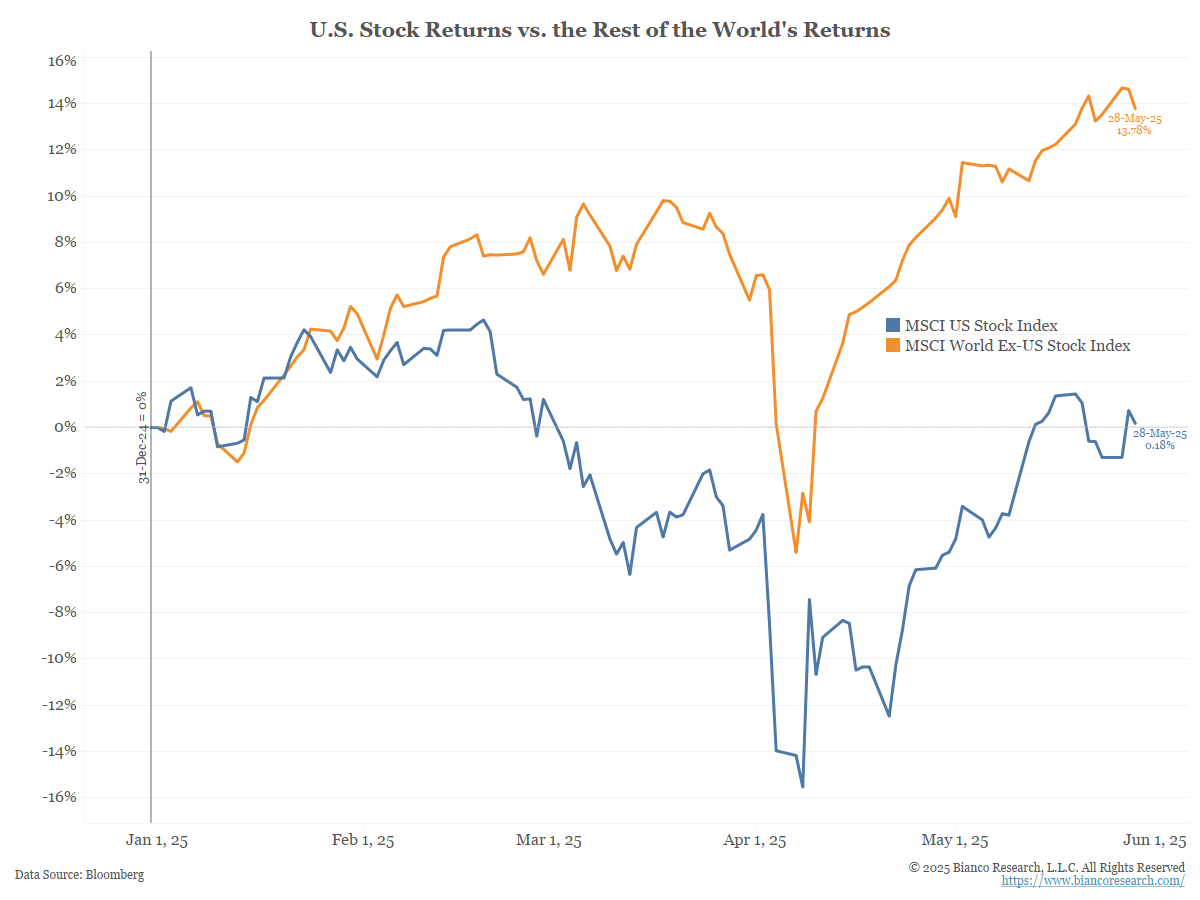

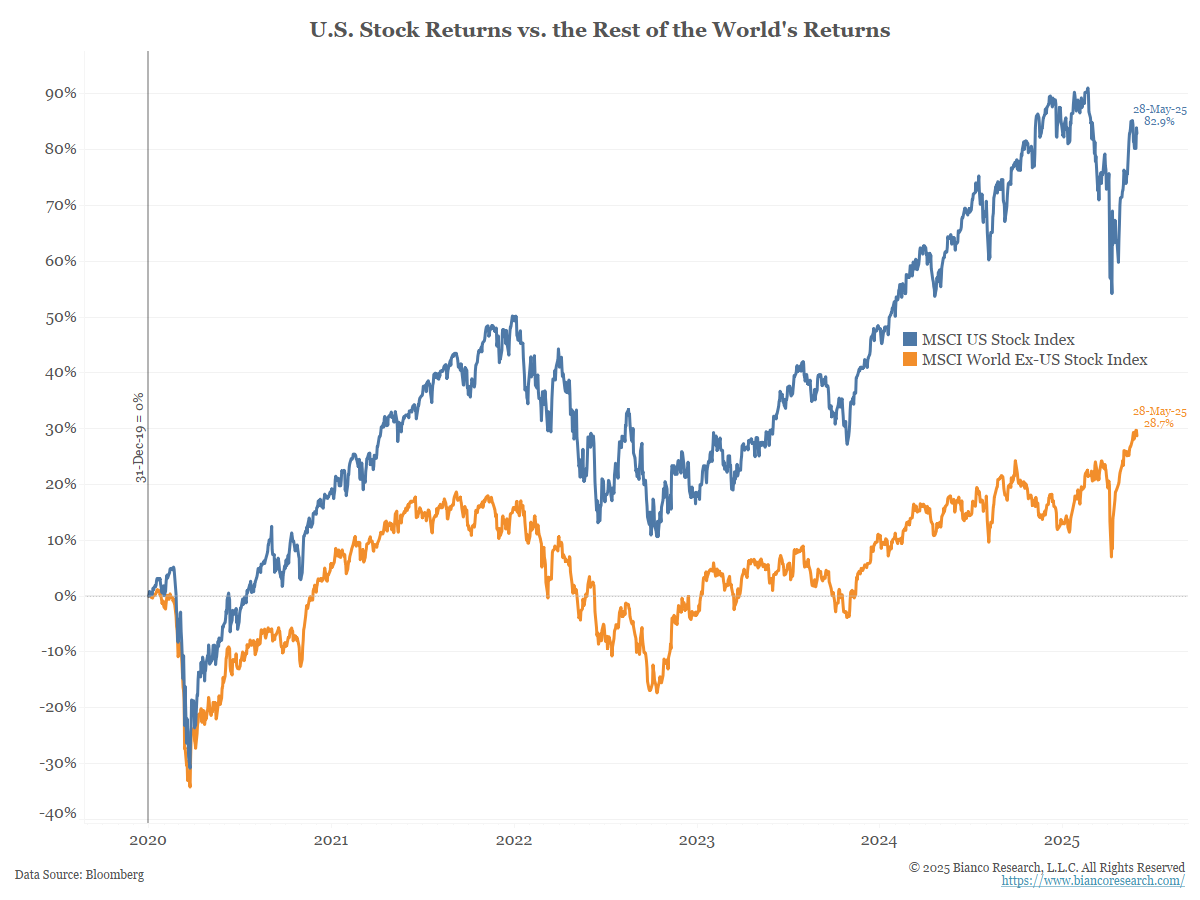

John Luke: 2025 performance of US stocks vs. the rest of the world has been pretty weak

John Luke: but the 2025 catchup is tiny in comparison to the US dominance from 2020 through 2024

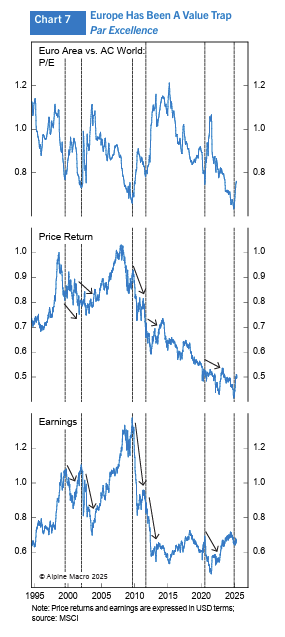

John Luke: The primary driver of US dominance has been superior fundamentals, as European companies in particular have continually failed to grow

Source: Alpine Macro as of 05.27.2025

Source: Alpine Macro as of 05.27.2025

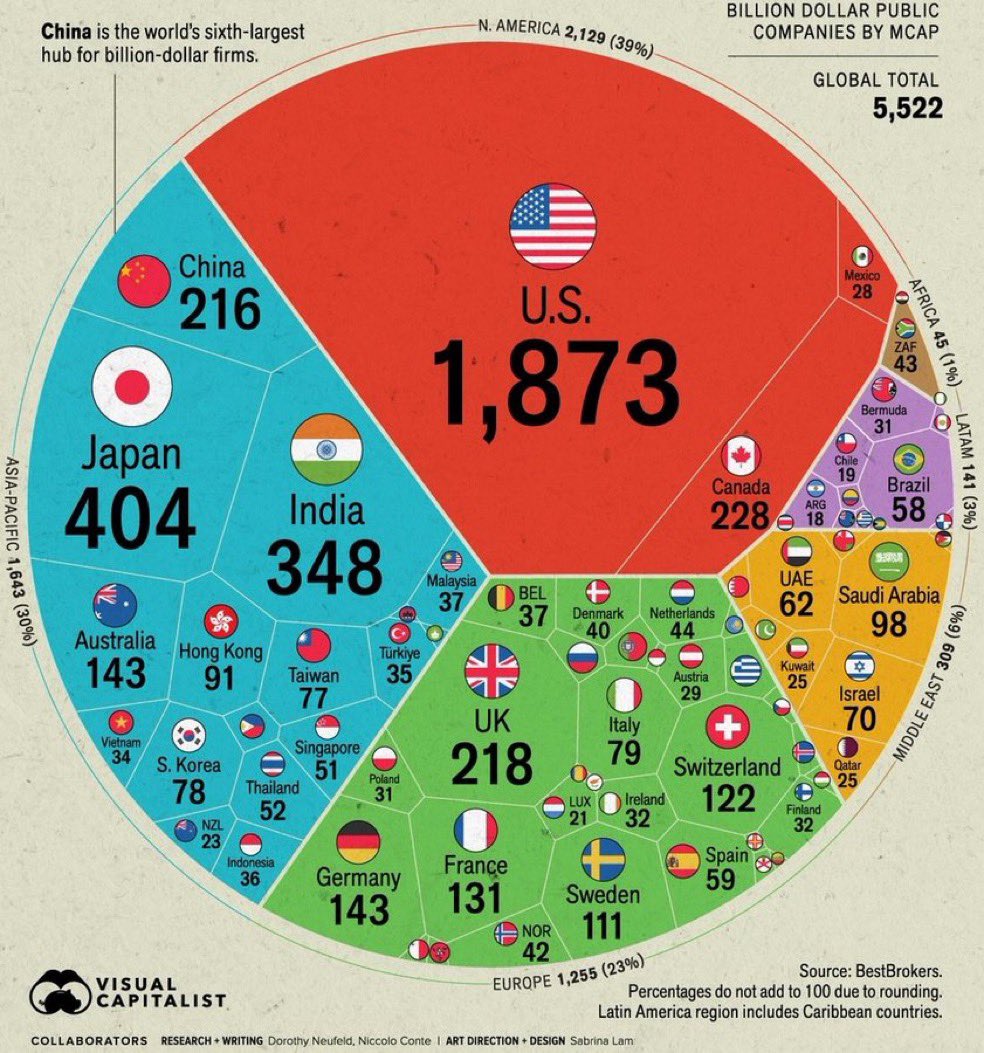

Jake: and the US dominates the world in developing financially successful companies

Data as of March 2025

Data as of March 2025

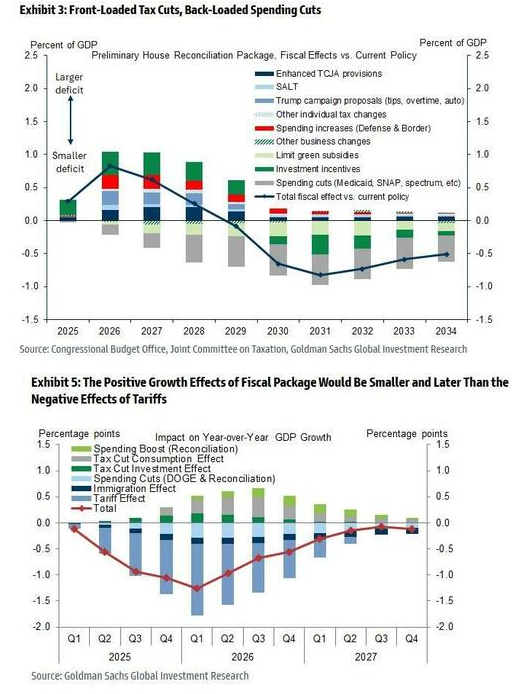

JD: We’re on to the “lower taxes and regulation” part of the DC agenda, with the proposed tax bill another source of juice for the economy

Data as of 05.23.2025

Data as of 05.23.2025

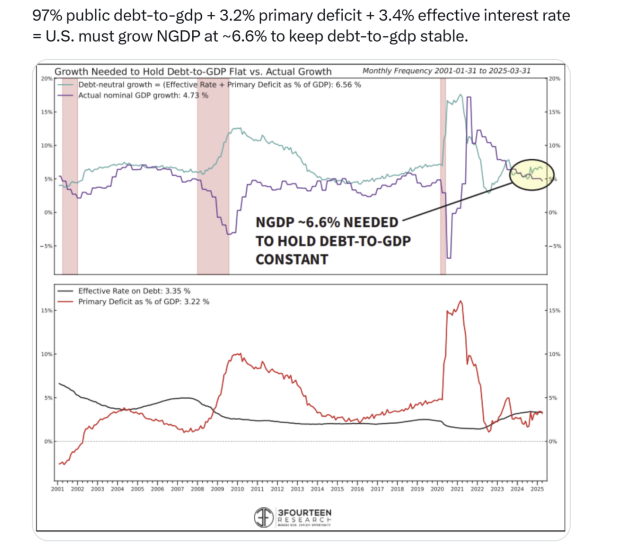

John Luke: and with the debt and deficit already in the danger zone, the policy approach would seem to favor running the economy fast enough to outgrow the expanding debt burden

Data as of 05.27.2025

Data as of 05.27.2025

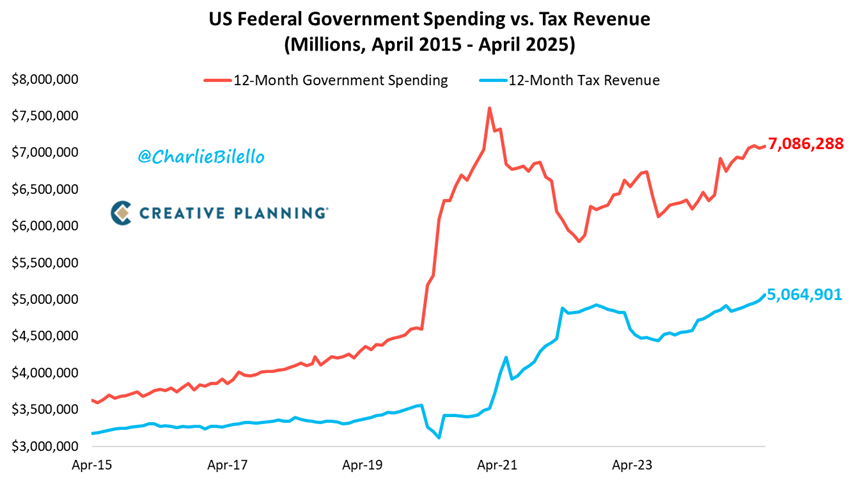

Ten: The US government has no appetite to reduce the growth of spending

Data as of 05.25.2025

Data as of 05.25.2025

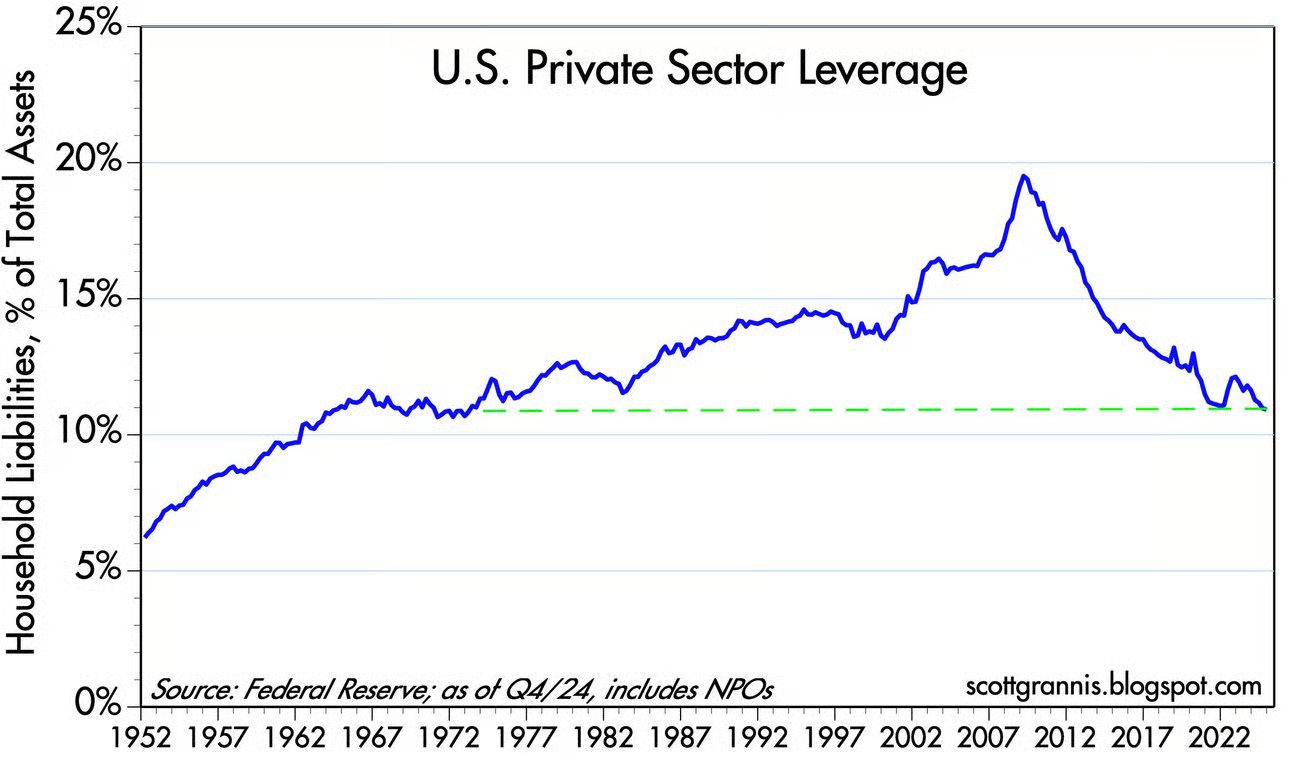

Brian: but US consumers have dramatically reduced their debt relative to assets

Data as of 05.28.2025

Data as of 05.28.2025

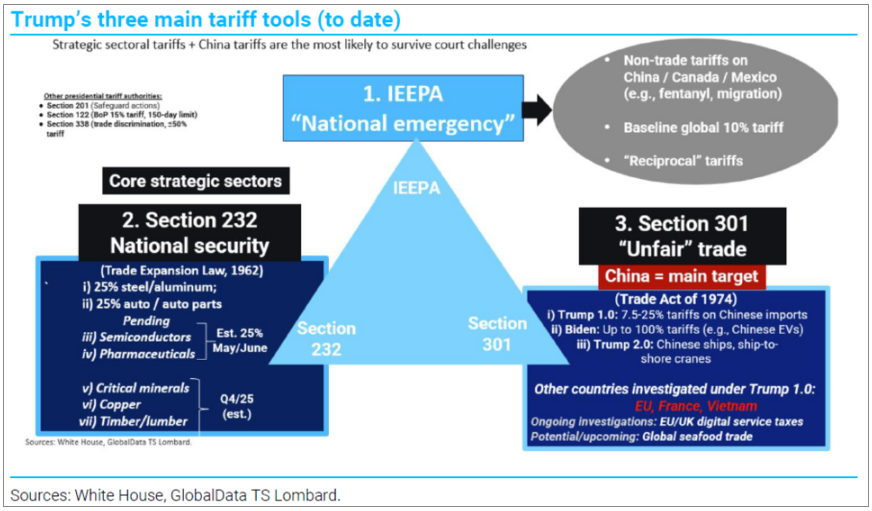

Brad: Market reactions to tariffs have become more tame, but there’s still a wide dispersion of possible paths

Data as of 05.29.2025

Data as of 05.29.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-24.