Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from rising yields and the economy, to earnings and tariffs and valuations. Enjoy!

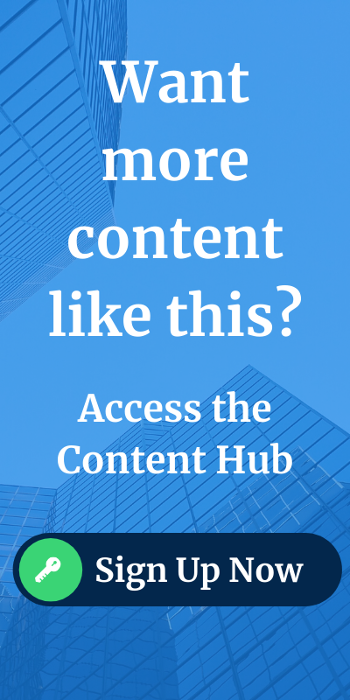

Beckham: Rising yields is not just a U.S. phenomenon

Data as of 05.22.2025

Data as of 05.22.2025

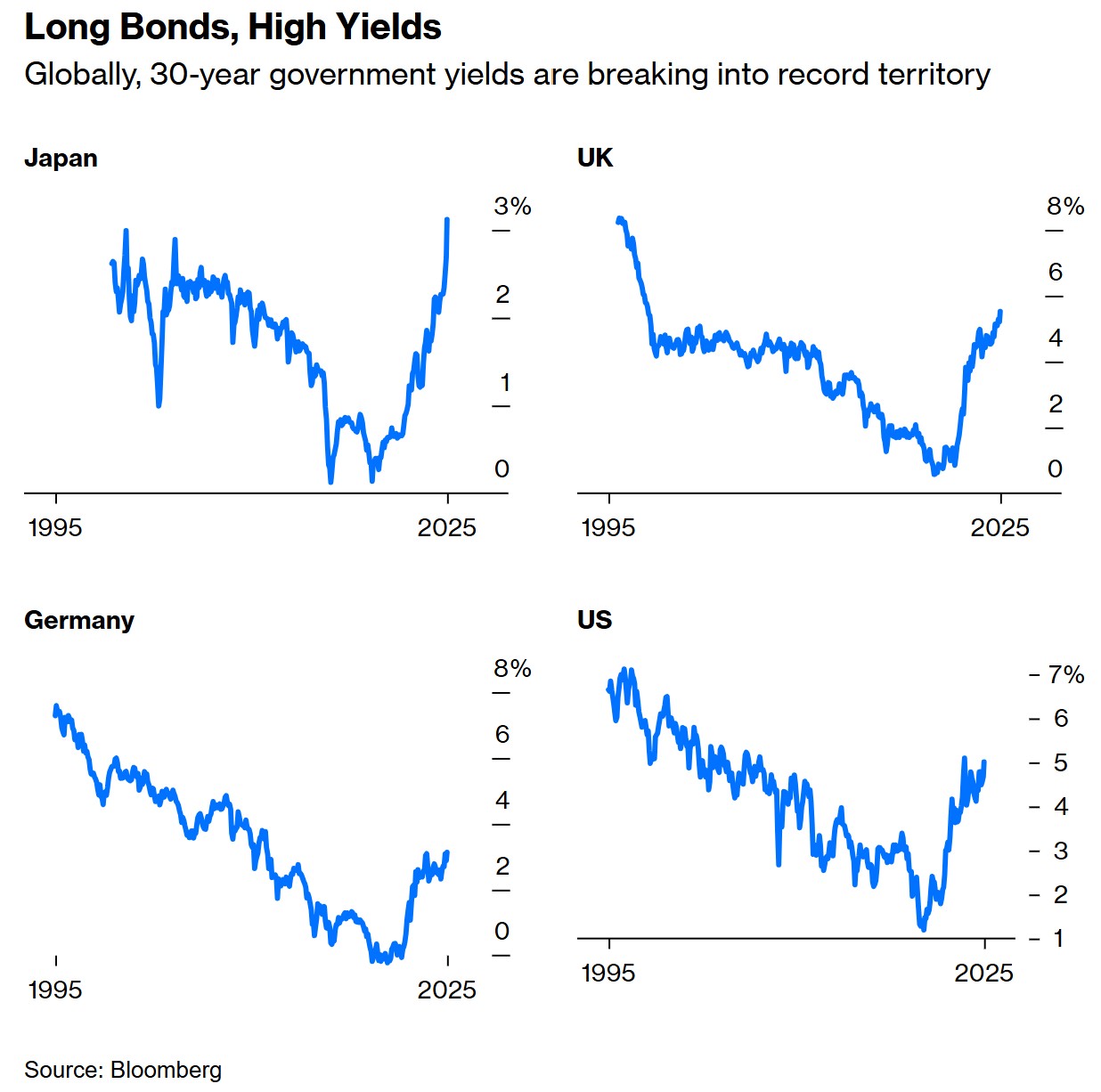

John Luke: though if you look at the past couple of years, it’s just been a rolling series of shifting narratives

Source: Piper Jaffray as of 05.21.2025

Source: Piper Jaffray as of 05.21.2025

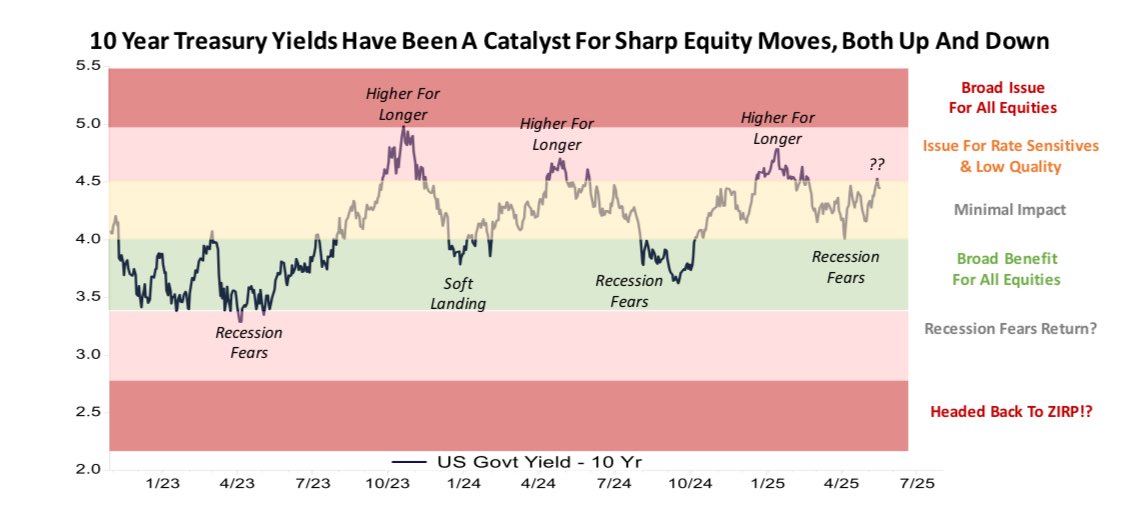

John Luke: either way, there’s no escaping the sharp rise in borrowing costs for the U.S. government

Data as of 05.16.2025

Data as of 05.16.2025

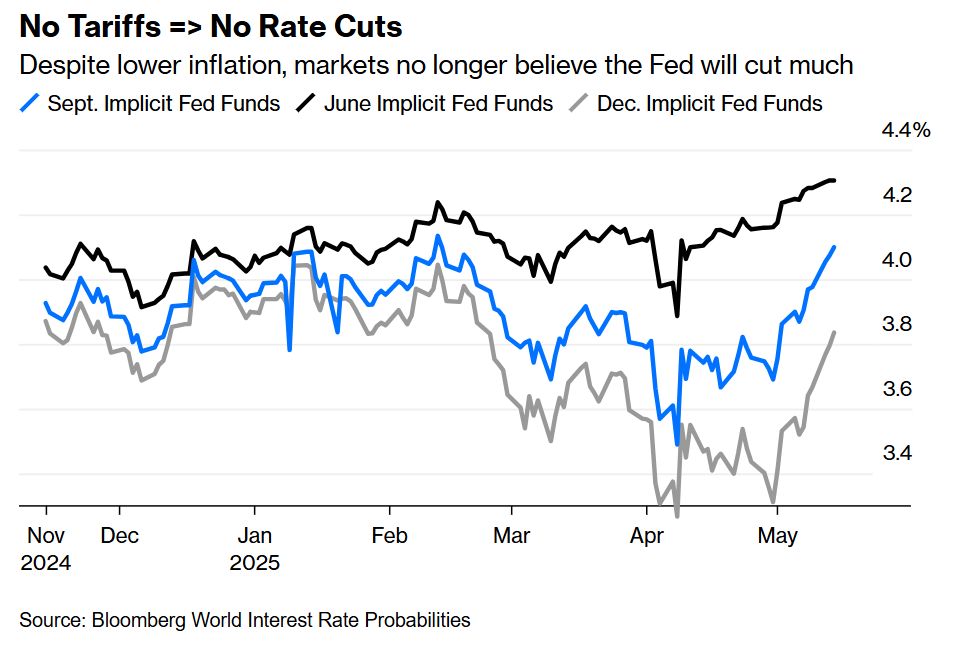

Brad: The current rates yo-yo revolves around the ongoing news cycle of high tariffs vs. low tariffs, and how that might flow into the Fed’s rate plans

Data as of 05.20.2025

Data as of 05.20.2025

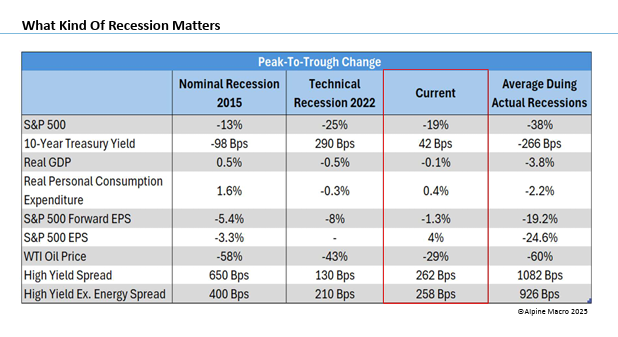

John Luke: Stepping away from the tariff discussions, conditions for a severe recession just don’t seem to be there

Data as of 05.19.2025

Data as of 05.19.2025

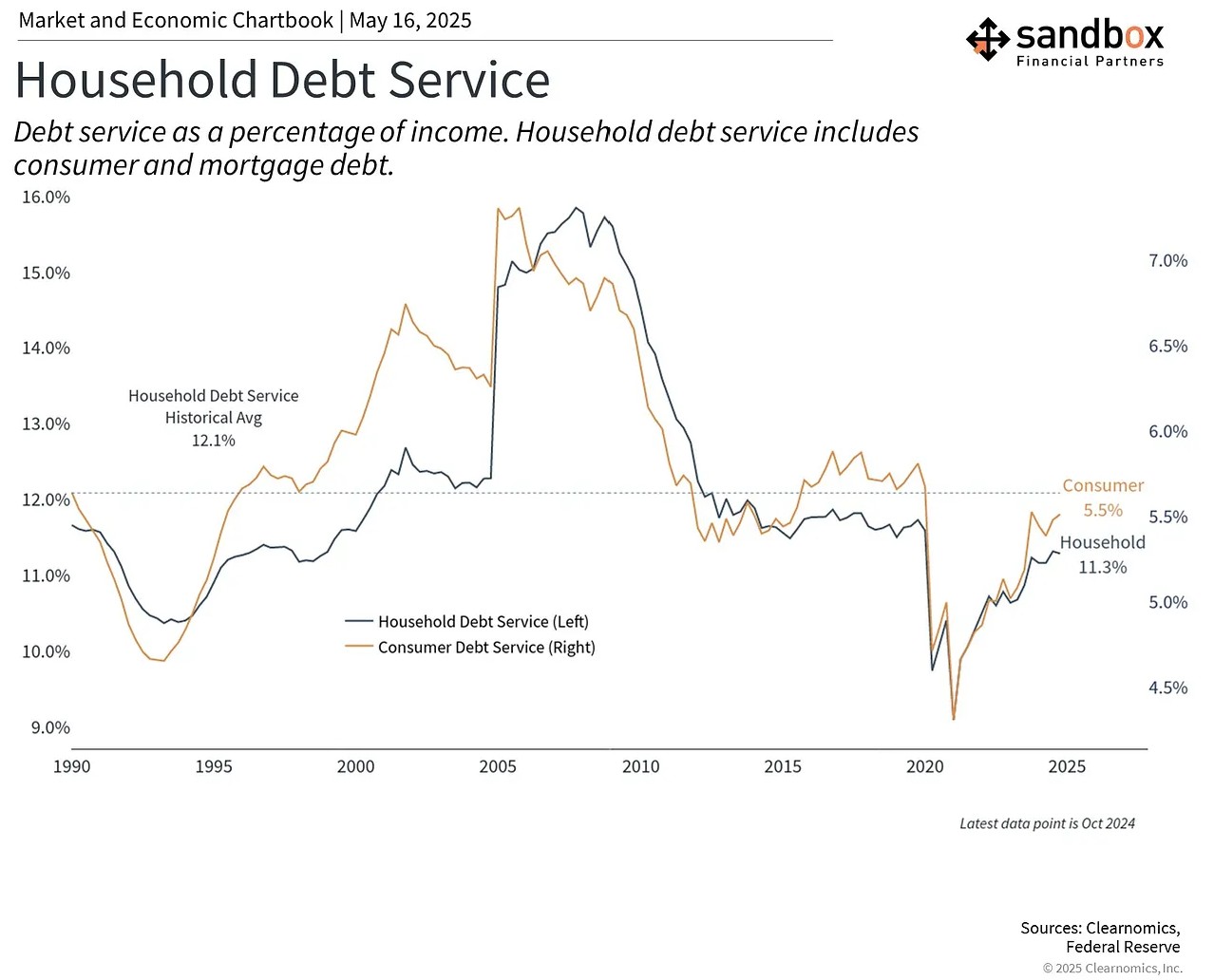

Joseph: and consumers in general remain in very good shape with respect to debt

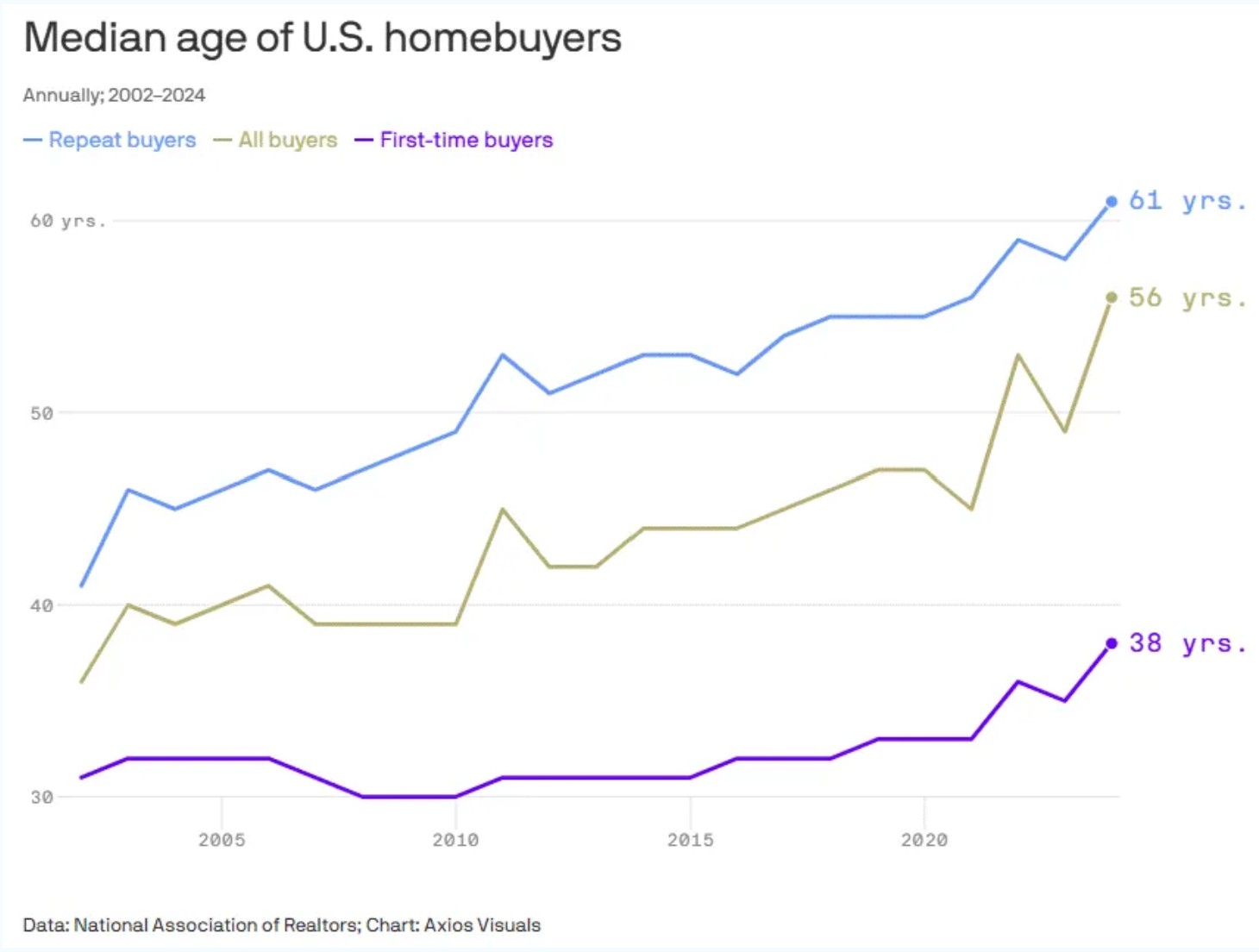

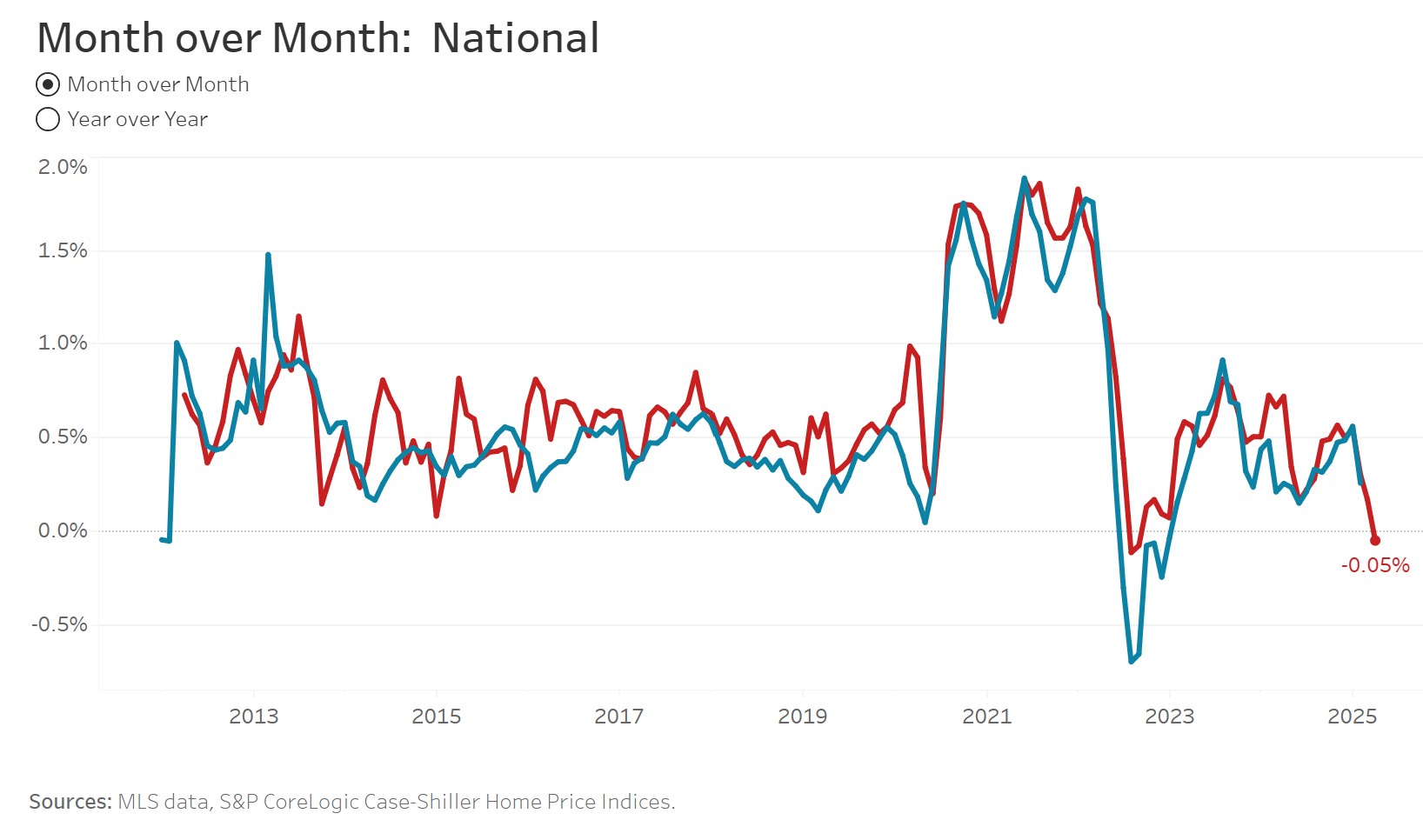

Brian: Younger buyers continue to have a hard time entering the housing market

Data as of March 2025

Data as of March 2025

Jake: which takes away a huge population of potential buyers in a market where prices have generally flattened

Data as of 05.16.2025

Data as of 05.16.2025

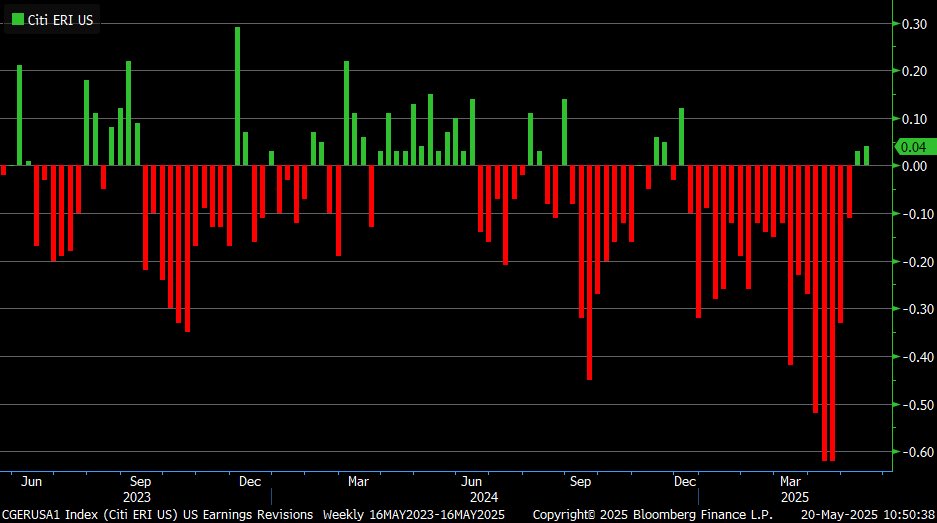

Brett: For the first time since before the tariff tantrum, consensus earnings estimates are rising

Source: @LizAnnSonders

Source: @LizAnnSonders

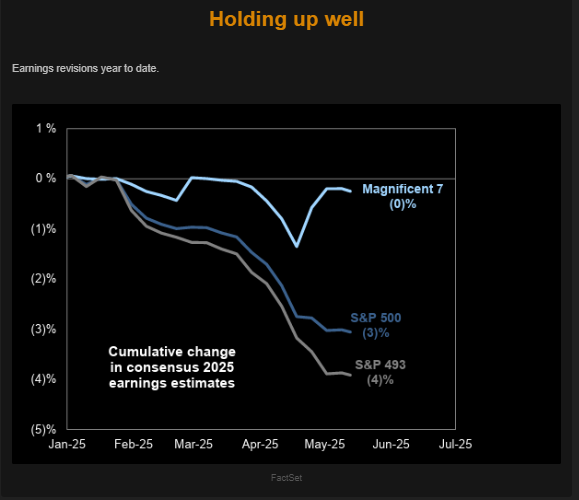

John Luke: with Mag 7 stocks leading the way with generally strong outlooks coming out of earnings calls

Source: The Market Ear as of 05.19.2025

Source: The Market Ear as of 05.19.2025

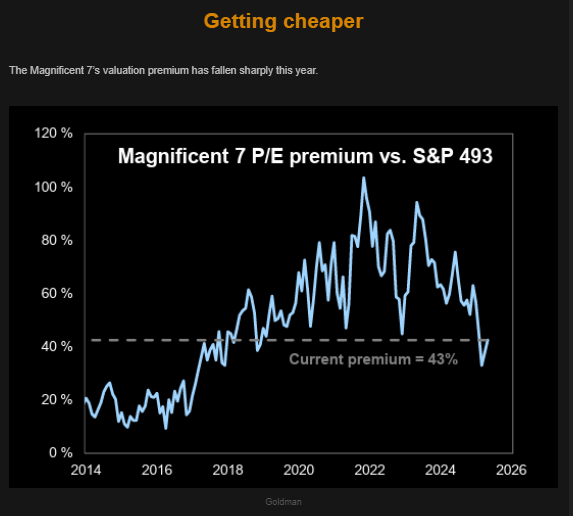

Dave: and that better relative earnings performance has narrowed the valuation gap between the Mag 7 names and the rest of the market

Source: The Market Ear as of 05.19.2025

Source: The Market Ear as of 05.19.2025

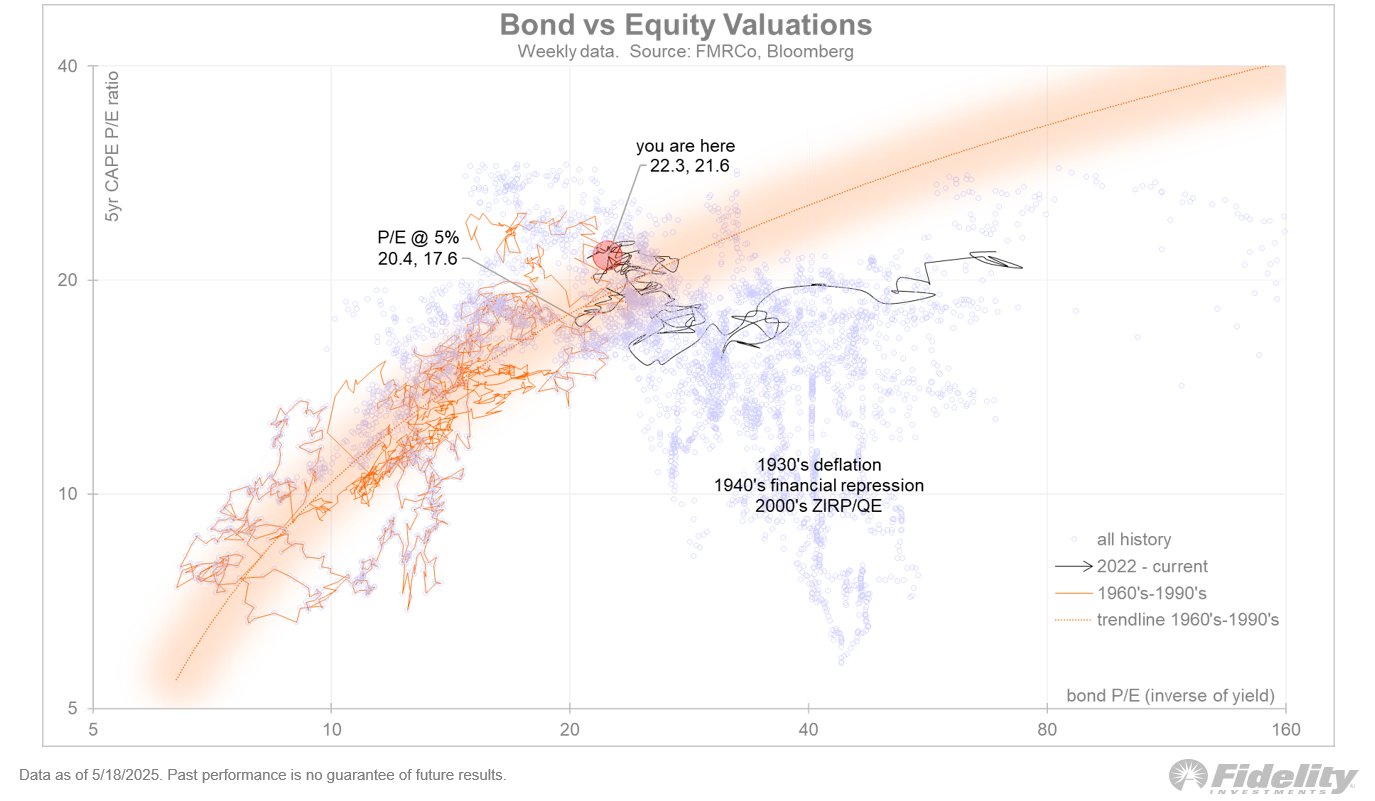

Arch: The cost of money has historically impacted equity valuations more in periods of positive correlation between stocks and bonds

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-21.