Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from the market bounce and poor sentiment, to earnings and the economy, to expectations for large vs. small stocks. Enjoy!

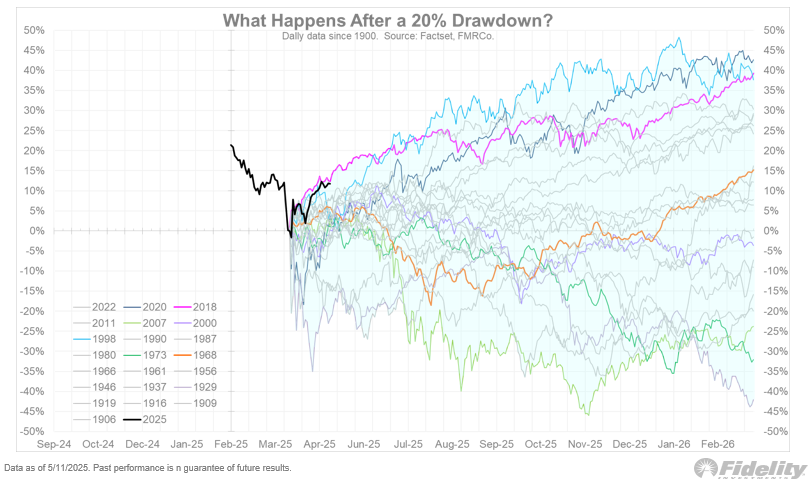

Beckham: It’s hard to classify this rally as a dead cat bounce, it’s been one of the better recoveries historically

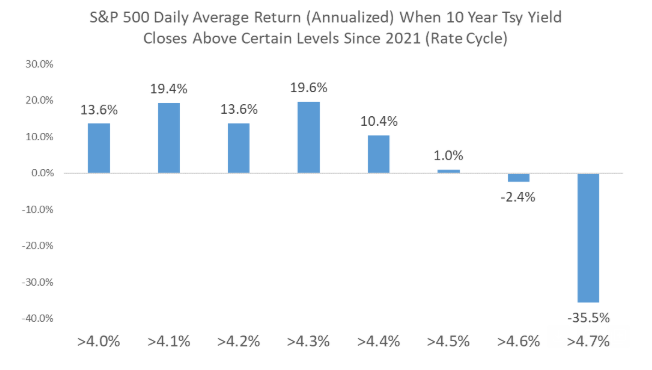

Dave: and one that’s being achieved with no help from the bond market

Source: Raymond James as of 05.14.2025

Source: Raymond James as of 05.14.2025

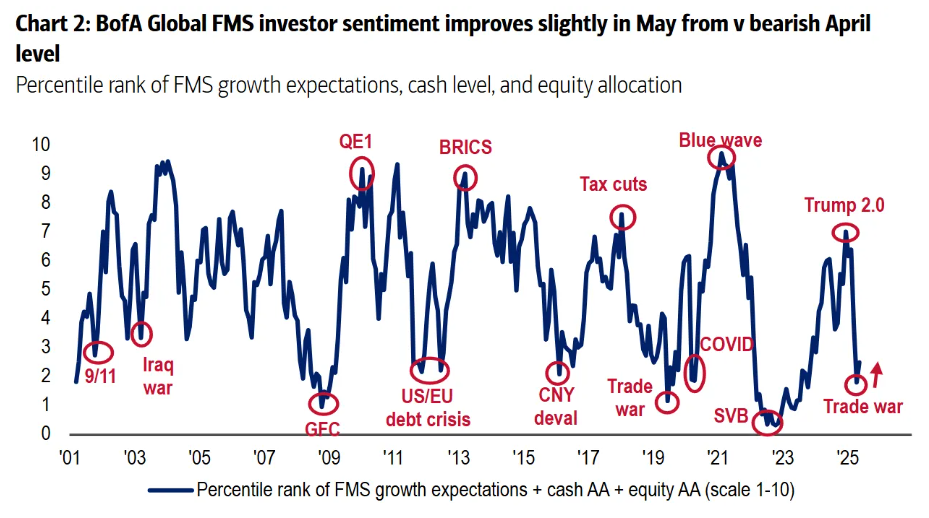

Ten: Fund managers as a group seem reluctant to join the rally

Source: BofA as of 05.12.2025

Source: BofA as of 05.12.2025

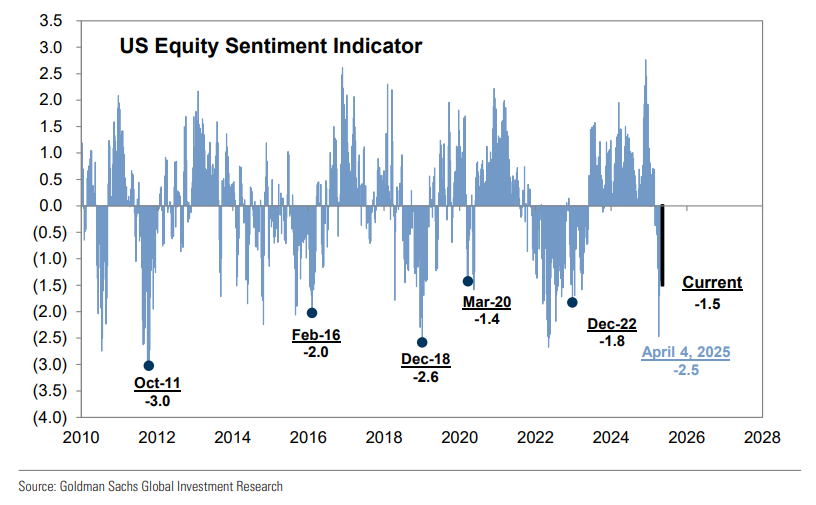

Mark: with investor sentiment measures still tracking far more concern than euphoria

Data as of 05.09.2025

Data as of 05.09.2025

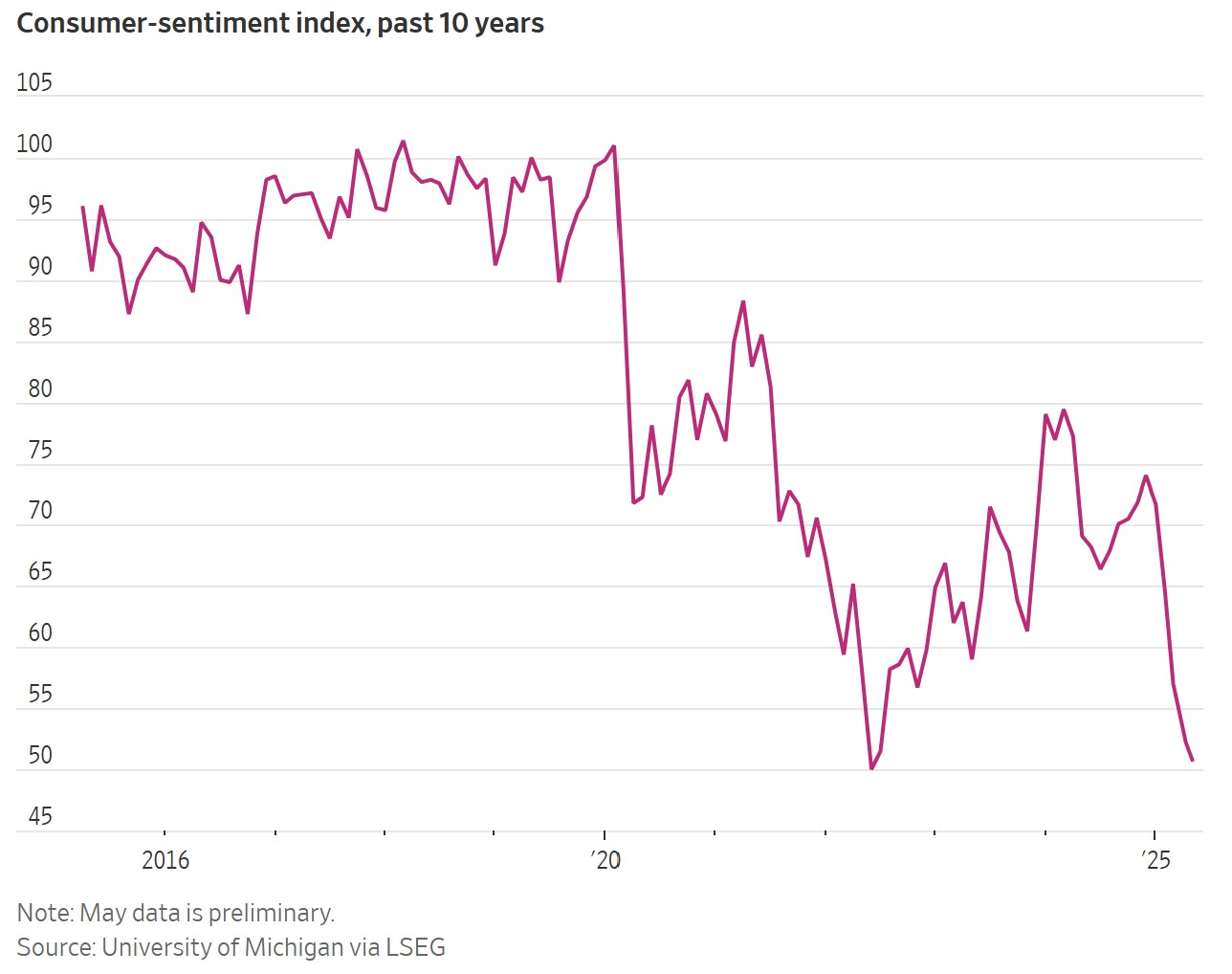

Brian: Speaking of sentiment, US consumers report themselves to be just as gloomy as fund managers

Graphic via WSJ as of 05.16.2025

Graphic via WSJ as of 05.16.2025

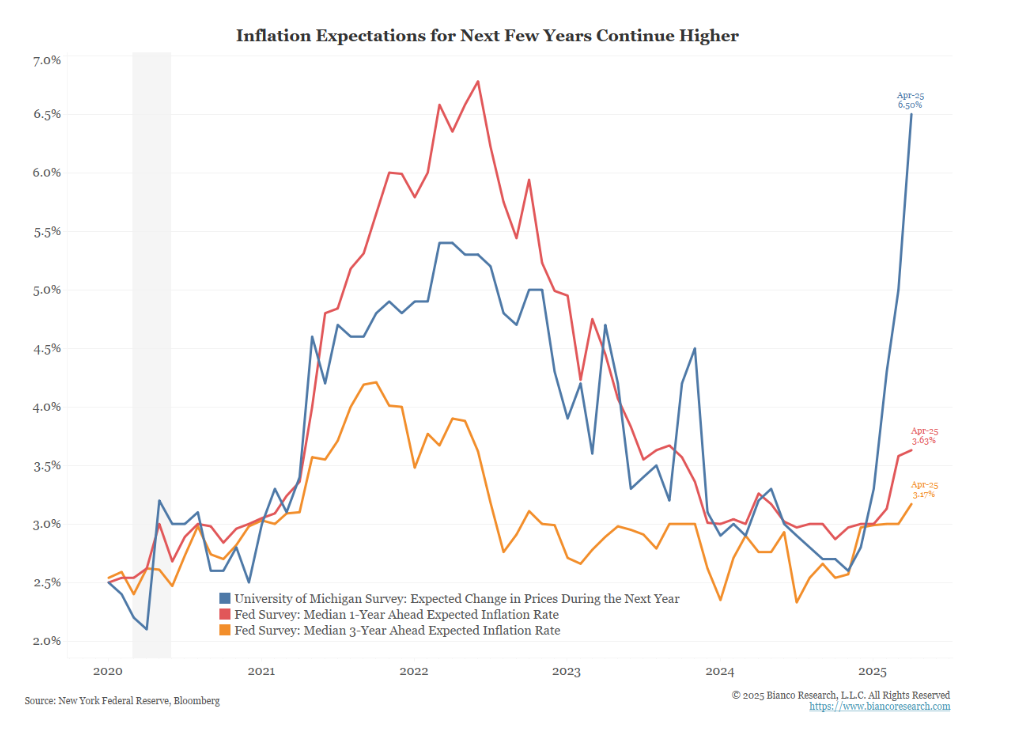

Dave: with inflation expectations a particular sore spot and far above market and economist expectations

Data as of April 2025

Data as of April 2025

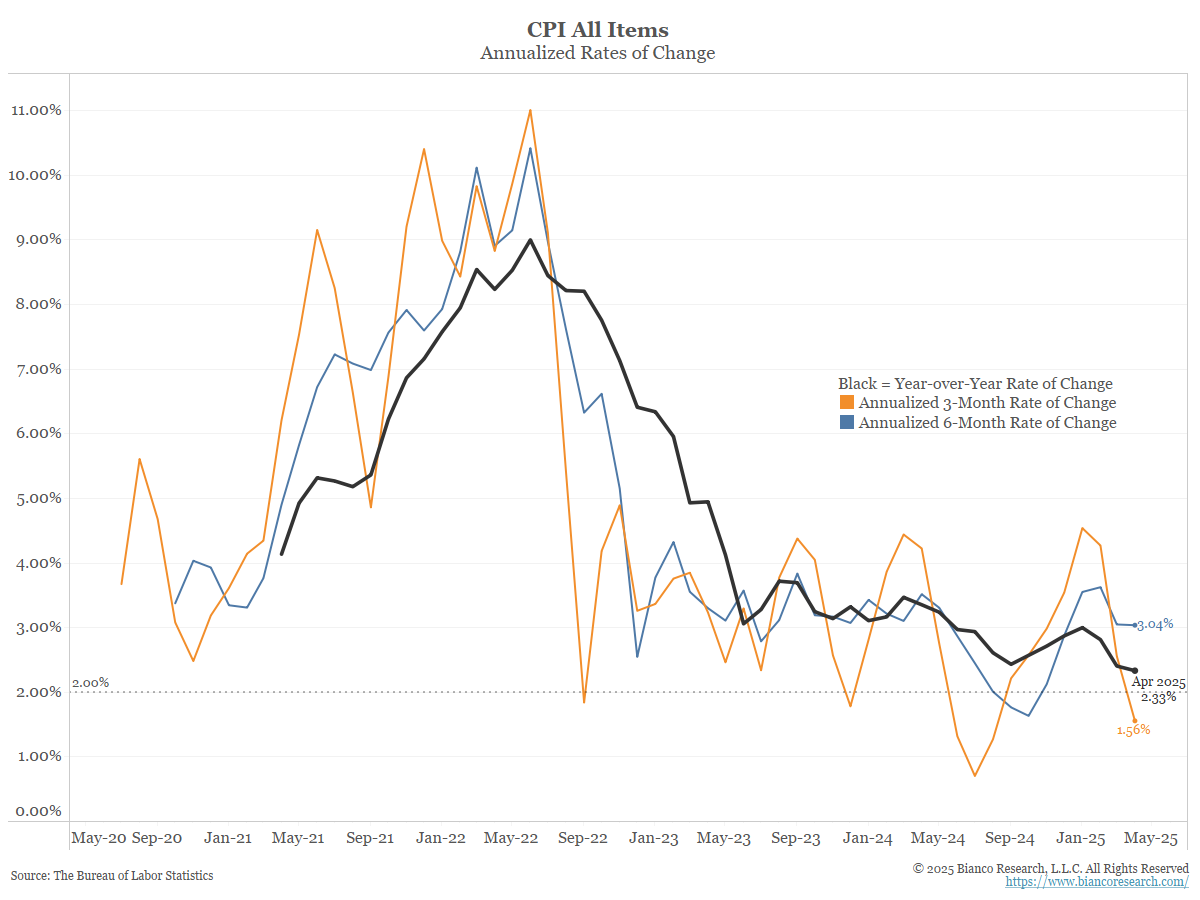

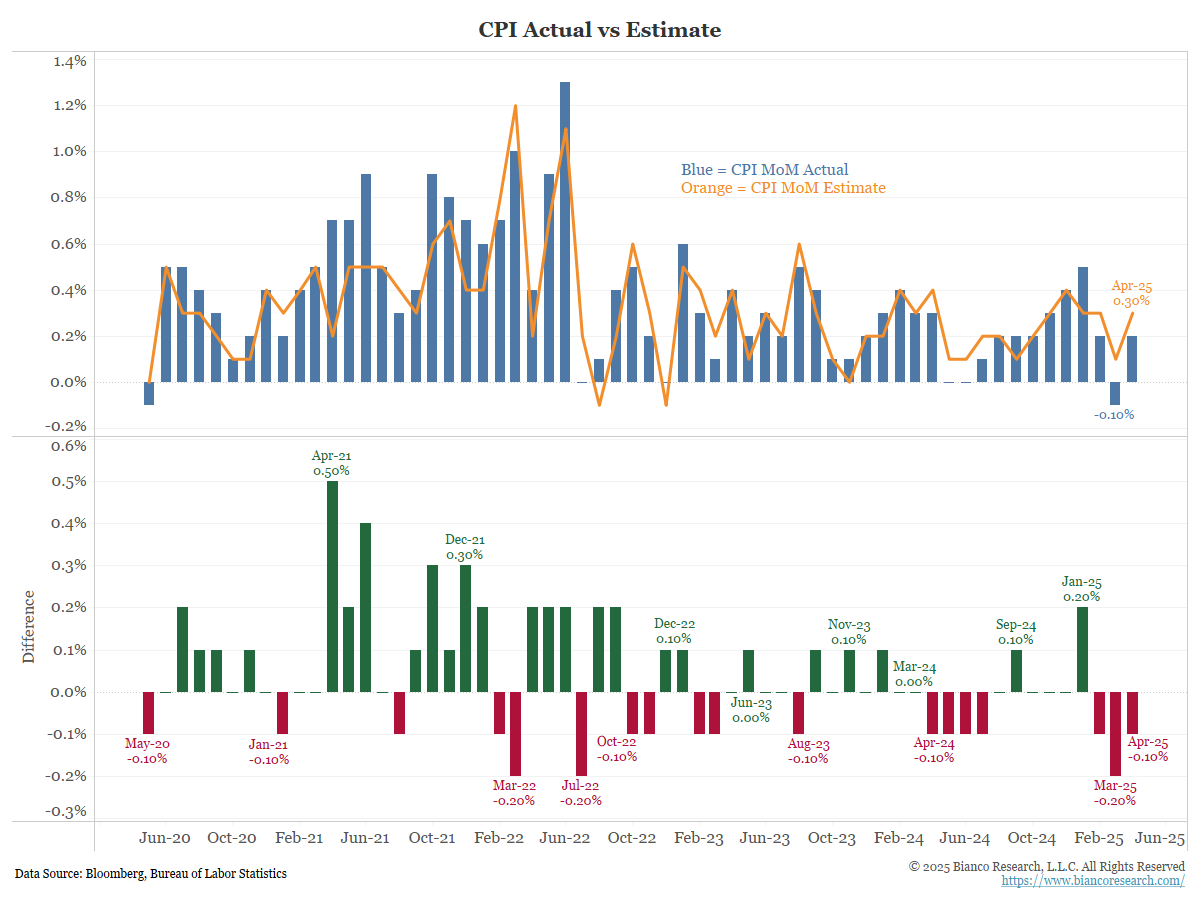

John Luke: The ironic thing is that actual inflation measures continue to fall towards FOMC targets

Data as of 05.14.2025

Data as of 05.14.2025

John Luke: and CPI has been below expectations in each of the past 3 monthly reports

Data as of 05.14.2025

Data as of 05.14.2025

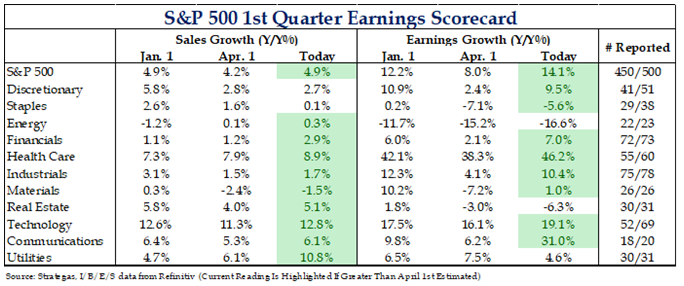

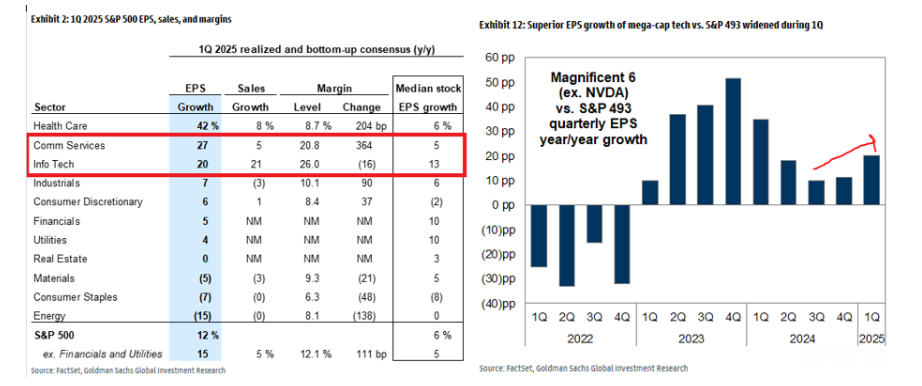

Brad: Walking back stated tariffs has been a big contributor to the market recovery, but Corporate America has been a big contributor as well

Data as of 05.13.2025

Data as of 05.13.2025

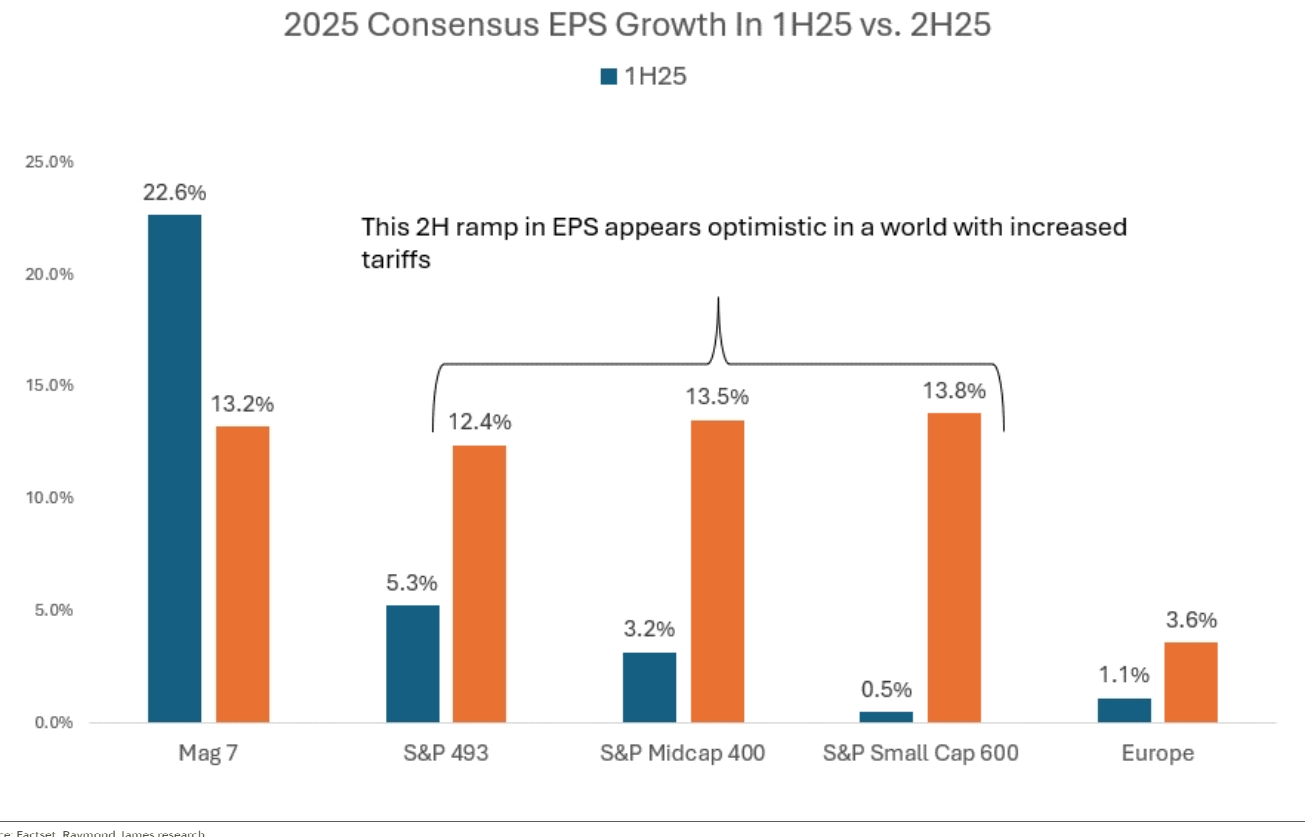

Dave: though the bar looks really high for the 2nd half of 2025

Source: Raymond James as of 05.09.2025

Source: Raymond James as of 05.09.2025

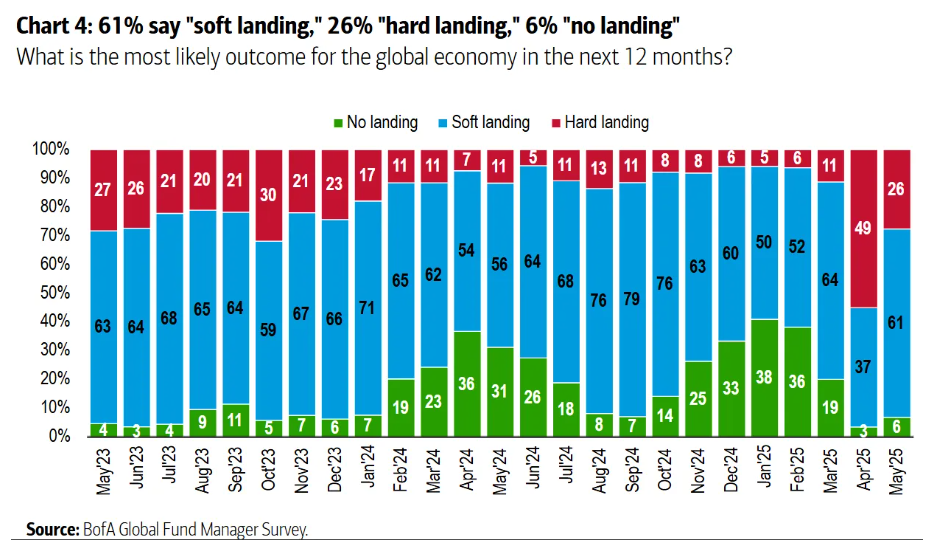

JD: Recession expectations are receding nicely, as investors re-embrace positive growth estimates

Data as of 05.09.2025

Data as of 05.09.2025

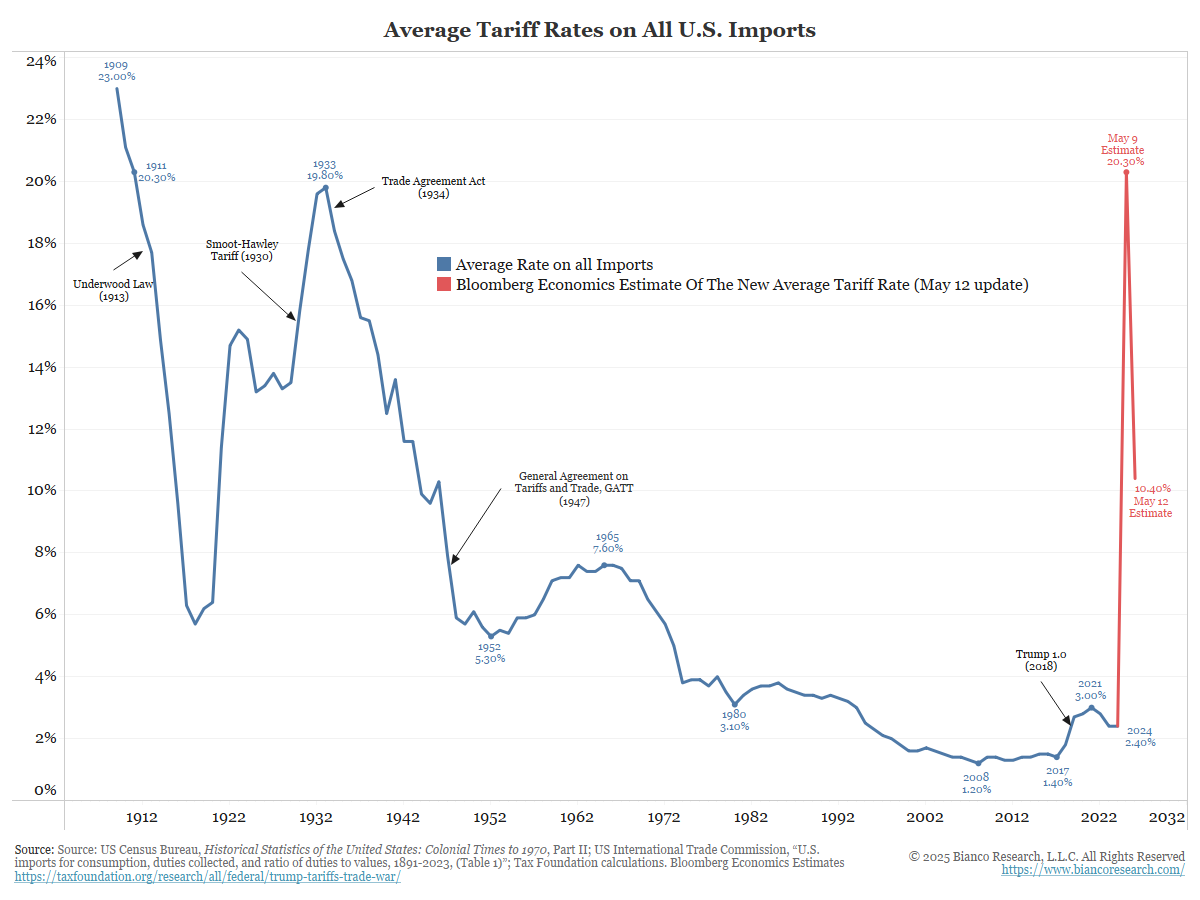

John Luke: as market participants digest the impact of tariffs that look to be higher but not as high as feared

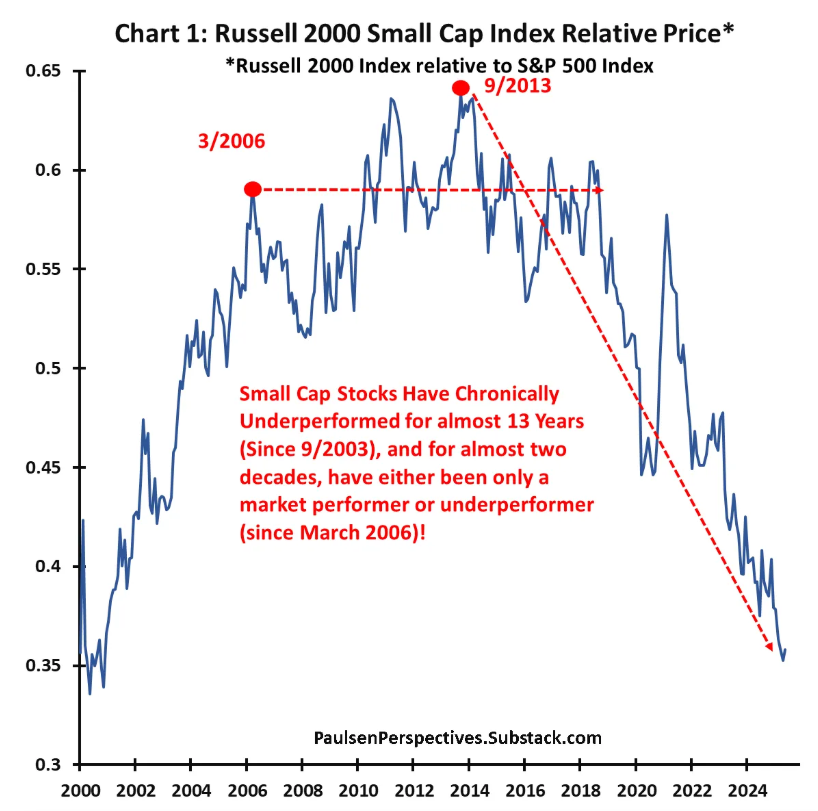

Brad: Small cap stocks remain unable to sustainably outperform large caps

Data as of 05.15.2025

Data as of 05.15.2025

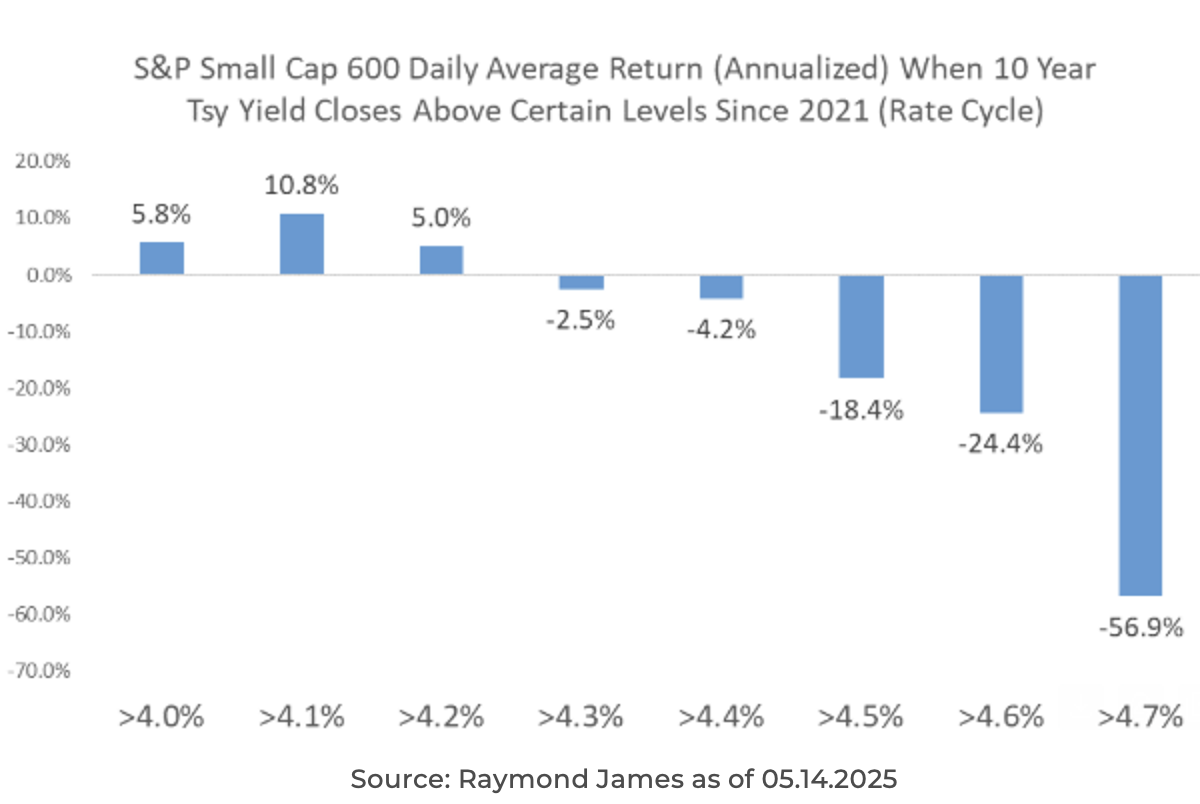

Dave: and concerns of higher rates won’t help their case

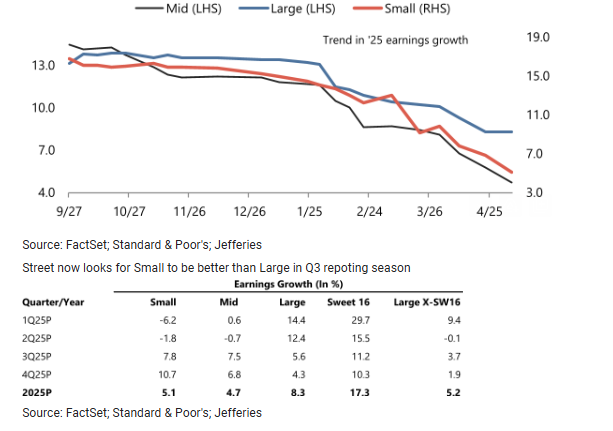

Dave: What small caps need is better earnings growth, which has been lacking for the past 9 quarters

Data as of 05.13.2025

Data as of 05.13.2025

Dave: with the constant hope that the improvement will come “next quarter”

Data as of 05.14.2025

Data as of 05.14.2025

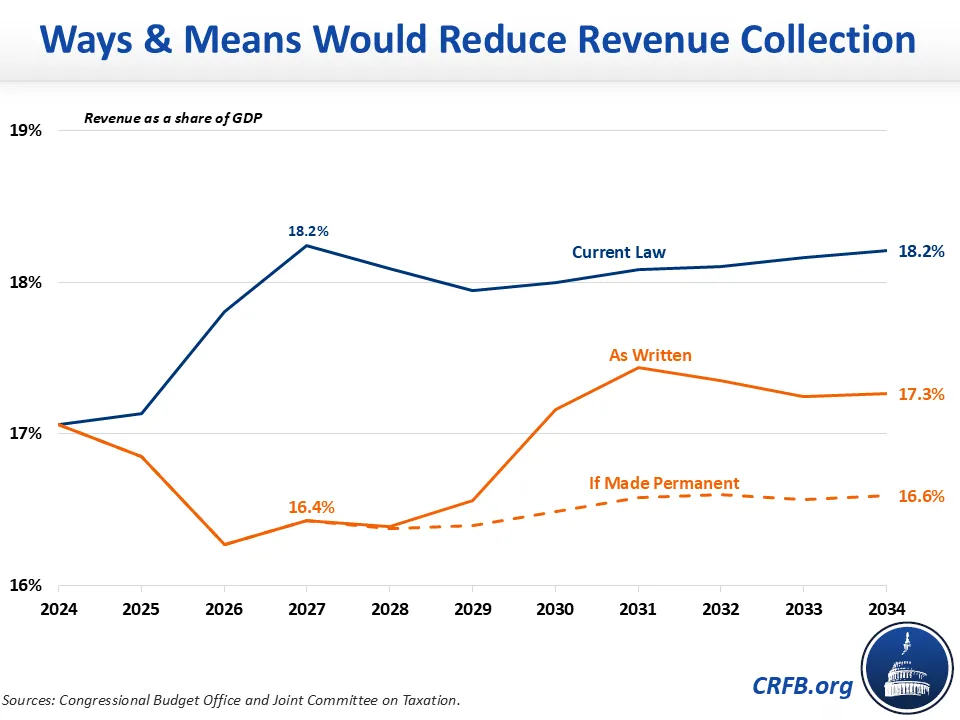

John Luke: Markets are moving from the veggies (tariffs) to the dessert (lower taxes)

Source: CRFB as of 05.13.2025

Source: CRFB as of 05.13.2025

John Luke: with uncertainty around the specs but a clear trend toward higher deficits

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-15.