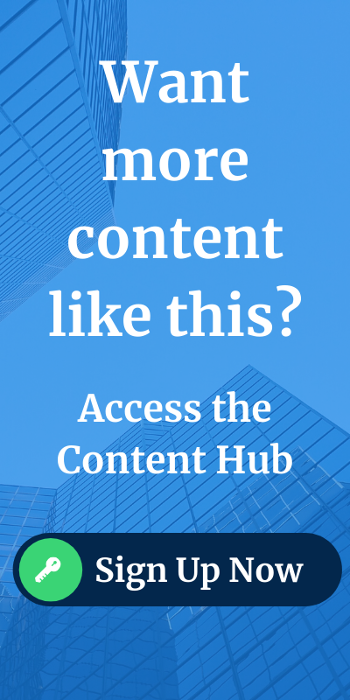

While there is certainly a lot going on in rates markets, it’s been interesting to see participants give more attention to the fiscal backdrop of the US government. It comes as no surprise that the weighted average cost of our government debt has increased dramatically over the past 4 years, while the level of debt has increased by >40% over the last 5 years ($36.2 trillion now vs $25.7 trillion in June of 2020).

The graphic below (blue line) shows the weighted average cost of our debt, which sits currently at ~3.3%. The red line shows the net interest cost as a percentage of tax receipts, which currently sits at about 18%, several percentage points above the 14% level where bond vigilantes have historically begun to push austerity measures.

Keep in mind that 2024 was a record year for tax receipts on the back of strong asset market performance.

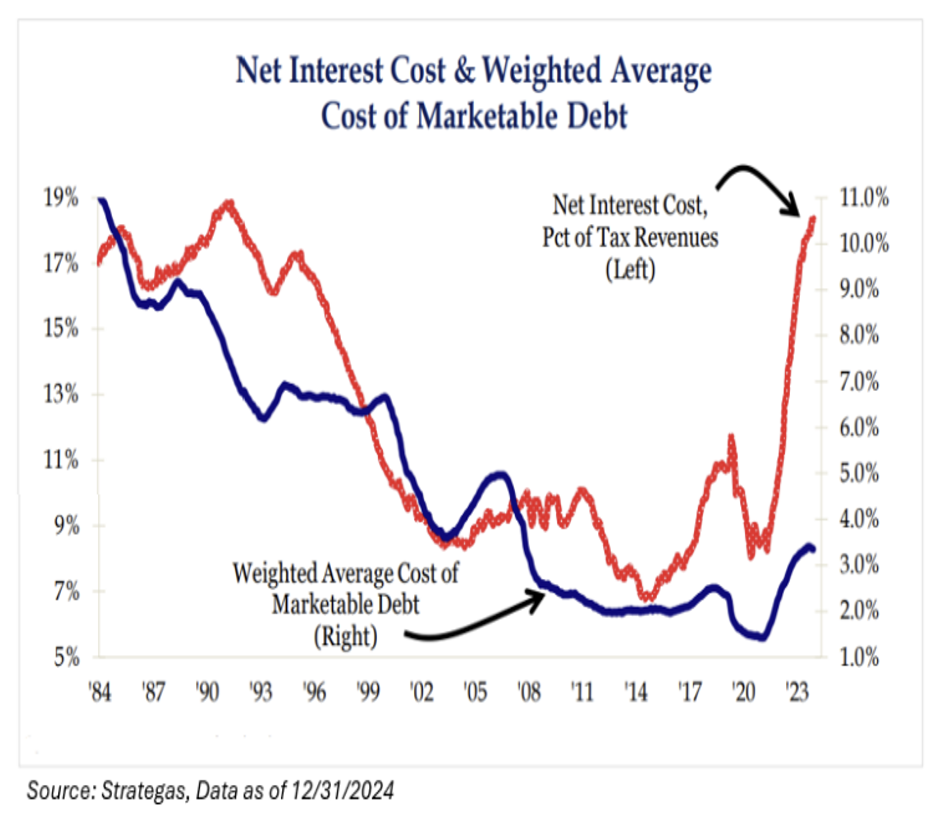

10 Year Yield Components

We’ve gone through this exercise in the past, where we look to break down the US 10-year yield into its three components:

-

- Inflation expectations,

-

- Real yields (the expected path of monetary policy), and

-

- The term premium

All 3 components of the yield have increased since COVID. First, we had inflation, then the tighter policy (which hasn’t totally cured the inflation), and recently, a widening in the term premium.

What should we make of these moves? On inflation, the situation isn’t surprising. As we have said repeatedly since COVID, the prevailing tendency of inflation has shifted. 2% was a ceiling on inflation in the 2010s and is now serving as a floor. Why? We think because of a faster growing economy, fiscal policy responses, and tighter labor markets.

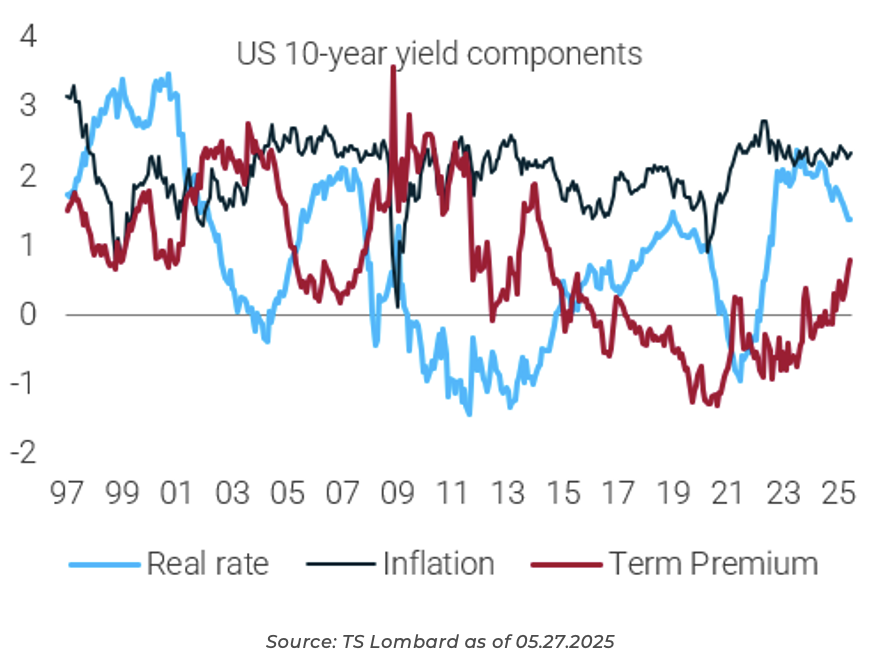

Real Yields

Central banks have kept rates high, and their economies haven’t crumbled. The explanation:

-

- A decade of deleveraging after the Global Financial Crisis (GFC) has left balance sheets in their best shape since the 90s

-

- Fiscal policy is now more activist (a different fiscal/monetary mix than past cycles)

-

- Aging demographics

-

- Looking ahead to the massive investment needs of the 2020s

If you are inclined, you could say that the imaginary r* (natural level of interest rates) has risen. 10-Year real yields currently sit above 2%.

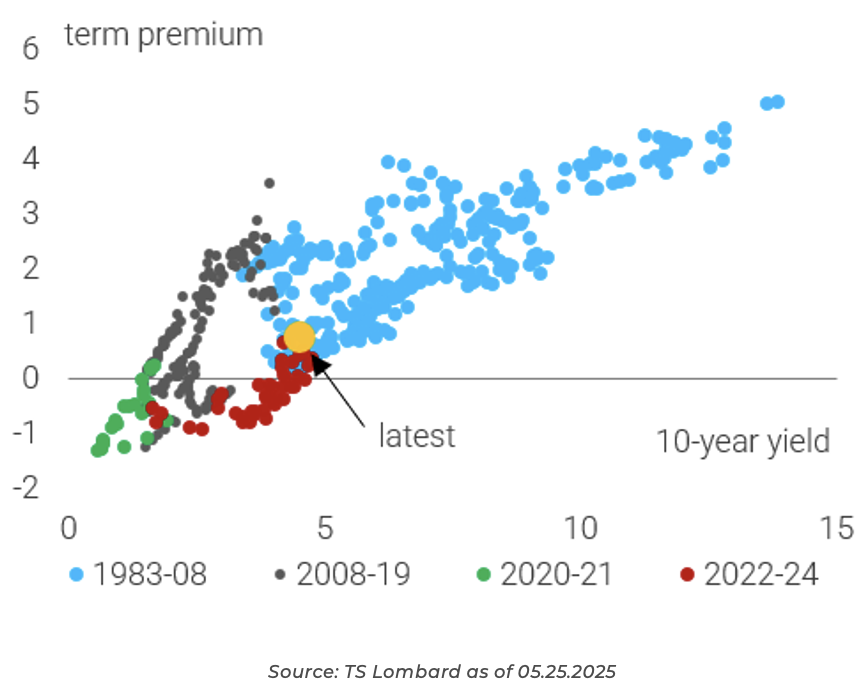

Term Premium

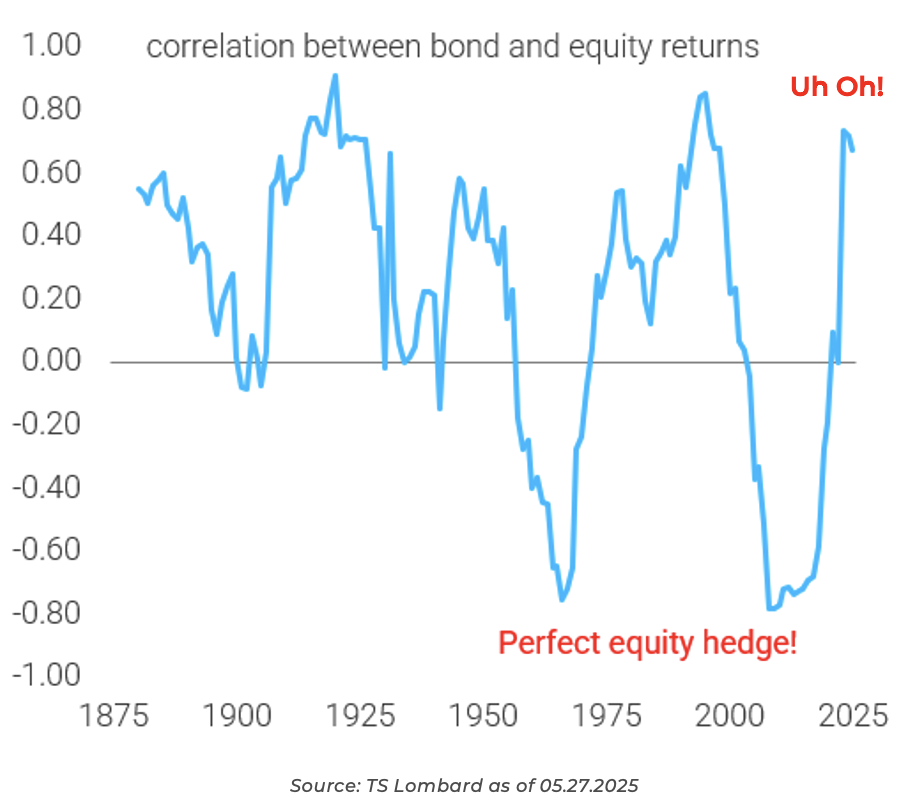

The Term Premium is the extra yield investors demand for holding long-dated securities rather than rolling over short-dated paper. The popular trope is that it reflects “fiscal risk”, or “too much issuance” or, when absent, manipulation such as Quantitative Easing (QE). The boring reality is that the Term Premium reflects the hedging properties of government bonds. In addition, rising term premia can strike fear into equity investors.

For two decades, bonds were a positive carry equity hedge. Investors only had to think about demand shocks, which meant inflation moved in tandem with GDP. In a recession, bonds rallied, cushioning equity losses.

Meanwhile, everyone had faith in policymakers (Fed Put). You could rely on the Fed to keep expectations anchored, which meant you didn’t need to worry about stagflation. When bonds had these properties, investors paid an insurance fee to hold them – hence a negative Term Premium.

Bonds’ Ability to Hedge Equity? Diminishing

We’re now ready to talk about the real danger in bonds. While the rise in yields has been mostly benign (so far), it is worrying that the hedging properties of bonds have deteriorated, and the term premium is edging higher. Bond and equity returns have been positively correlated, which is not what you want if you are looking for insurance.

Remember, bonds can’t grow, and are at the mercy of the government protecting their purchasing power (by limiting debasement). Given US Treasury Secretary Scott Bessent’s recent comment on growing the economy faster than the growth of the debt, market participants are taking notice.

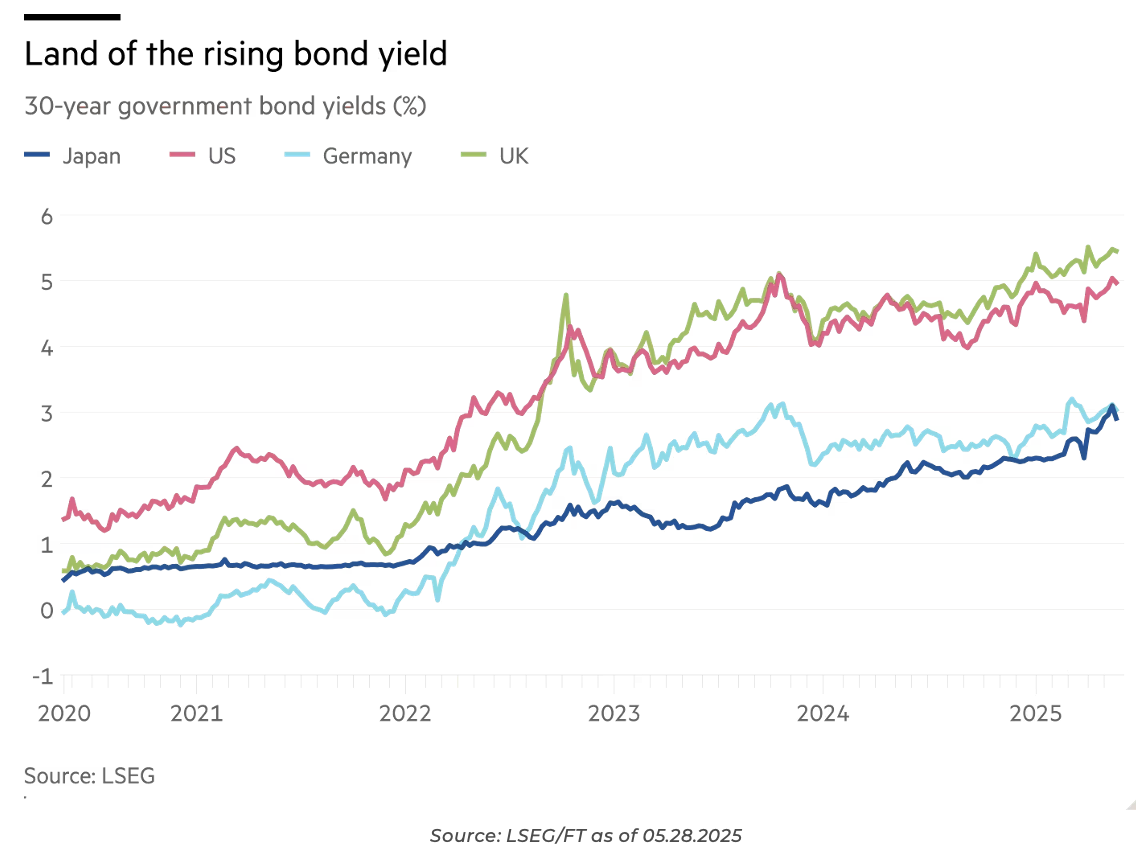

Long-Term Bonds Are Being Impacted

Bond investors are showing an unwillingness to lend to at below inflation rates to fund (reckless) government spending forever. The circumstances for each country may vary but the underlying force is identical…post-COVID, the world has changed. Inflation is higher, central banks are not buying up bonds as they once did. But governments still want to borrow and run major deficits. Bond investors are requiring governments to more properly reward them for the risks (i.e., debasement).

In saying that, the benchmark 10-year Treasury yield, at 4.5%, is more than a percentage point lower than its historical average of 5.6% since the 1950s. Even if you remove the period from 1980 to 1985 in which the 10-year yield was persistently above 10%, that historical average declines only modestly to 5.1%, still well above the current yield.

Most investors have been influenced by the ZIRP-like policies of the post-GFC economy, which we believe are unlikely to return.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-23.